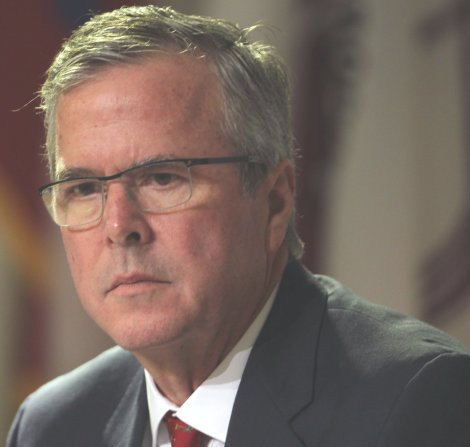

His tax plan does not make him a very nice man...

Jeb Bush wants three income-tax rates on regular income — 10%, 25% and 28% (the top rate is currently 39.6%).

And Jeb wants to lower the corporate tax rate from 35% to 20% (even though many corporations don't come close to paying 35% anyway).

And Jeb wants to lower the capital gains tax rate from 23.8% to 20% (what the super-rich earn from stocks, etc.)

And Jeb wants to completely eliminate the inheritance tax (even though the first $10.86 million is already exempt).

Jeb Bush is no different from this brother George W. Bush — and why he doesn't use his last name in his presidential campaign (Jeb!) because he doesn't want to remind us how awful he would be. Here's a 6-minute reminder of his brother's economic policies:

Jeb Bush's new tax plan would be like his brother's tax cuts on steroids.

Posted by Bud Meyers on Saturday, September 12, 2015

George W. Bush: "This is an impressive crowd — the haves and the have-mores. Some people call you the elite; I call you my base." — From his speech at the annual Alfred E. Smith Memorial Foundation Dinner on October 2000 (Video here on YouTube)

Of course (like all GOP tax plans) Jeb's tax plan would mean less tax revenues, which will force more cuts in government spending (the GOP Plan: Starve the Beast) — and Jeb's plan will be one heck of a tax cut for the super-rich — just like his brother's was.

And just like most other GOP tax plans, it throws a bone to the desperate poor and the dwindling middle-class to lower their tax rates, but it mostly gives the super-rich the biggest tax cuts of all.

Why not just lower the tax rates for the poor and middle-class, those who've suffered stagnant and declining wages for the past 35 years; and just raise the tax rates on the super-rich, those who have done phenomenally well.

Jeb Bush (like all Republicans) falsely claims that more "growth" will mean higher wages for workers. Jeb knows this isn't true, and that profits have not "trickled down" to workers. So knowing that his economic plan will mostly benefit the super-rich, that makes him a very bad man. His tax plan proves that he's just another sleazy politician. (The links below should make that very clear.)

From the media:

► New York Times (Paul Krugman) "The Jeb! tax plan confirms, if anyone had doubts, that the takeover of the Republican Party by charlatans and cranks is complete."

► The New Yorker: Jeb Bush and the Return of Voodoo Economics► MSNBC: Jeb’s tax plan makes George W. Bush’s policies look good

► L.A. Times: Jeb Bush unveils tax plan to slash rates for corporations and top earners

► New York Times: Jeb Bush’s Tax Plan Is a Large Tax Cut for the Wealthiest

► Washington Post: Jeb Bush rehashes Mitt Romney’s arguments to defend tax cuts for rich

► Mother Jones: Even Conservatives Agree That Jeb Bush's Tax Plan Is a Huge Boon for the Rich► Five-Thirty-Eight: Jeb Bush’s Tax Plan Is Pretty Weird, Mixing Romneyism with populism

► Washington Post: Jeb Bush’s tax plan is great ... for Jeb Bush

► Slate: Jeb Bush’s Tax Plan Is a Budget-Busting Giveaway to the Wealthy

► New York Magazine: How Jeb Bush’s Tax Cuts Suckered the Media

► Tax Justice: Jeb Bush Loves Tax Cuts, Especially for the Rich

► PoliticusUSA: Jeb Bush Crashes And Burns Immediately After Announcing Plan To Cut Taxes For The Rich

► The Daily Mail: Democratic Party says Jeb Bush's tax plan would have put $841,000 in his own pocket in 2013

► Salon: Jeb Bush gets caught flat-footed: Why more tax cuts won’t make the GOP base love him

► Citizens for Tax Justice: Jeb Bush's Tax Plan Is a Corporate Giveaway Disguised as Tax Reform

* Unfortunately, most presidential candidates (like most members of Congress) are more like the voracious rich, not the magnanimous poor. Bernie Sanders would raise Jeb Bush's taxes.

Associated Press: “Marco Rubio would give businesses a 25 percent tax credit for providing at least four weeks of paid family leave. It would be limited to 12 weeks of leave and $4,000 per employee. “

ReplyDeletehttp://hosted.ap.org/dynamic/stories/U/US_GOP_2016_RUBIO_TAX_CREDIT?SITE=AP&SECTION=HOME&TEMPLATE=DEFAULT

MY NOTE (And tell me if my math is wrong): Rubio's tax plan cuts the corporate tax rate by 8.75% (a 25% credit on a 35% corporate tax rate). If a company has $100 million in revenues, that saves them $8.75 million in taxes. If the company has 100 employees, that equals $400,000 MAXIMUM they’d pay out for paid family leave --- so a company can spend $400,000 to save $8,750,000. What a deal!

Not to mention, that's $8,750,000 less in tax revenues for the government to operate with, maybe forcing cuts to government programs that those very people on family leave might need.

But here’s the biggest rip off –> A hedge fund could rake in $1 BILLION a year — but only have 1 secretary and 1 receptionist who might use $4,000 each for family leave.

And yes, because of the number of employees, the GOP also likes to classify hedge funds as "small businesses" just to give them massive tax cuts.

http://www.bloomberg.com/news/articles/2012-03-08/hedge-funds-could-get-break-in-republican-small-business-20-tax-cut-plan

The Republicans constantly twist and contort the words in their tax plans to always cut government spending and give tax breaks to the rich --- but sometimes under the guise that they are giving something to the poor and middle-class. These people are fricking evil.