It's almost amazing, that many of those who govern this country and make public policy (and write about economics), have no idea what a real middle-class existence might be like. It's as though they're all living in their uppity high-income bubbles — and have absolutely no clue how the peons are managing to survive.

But on the other hand, many working people don't either — they think they are in the middle-class just because their neighbors might have the same standard of living as they do. I'm sorry to bust their bubble but, only about 20% of all wage earners are most likely in the middle-class — while the vast majority are in lower-middle-class or less.

That's not to say this class of lower-income people don't "have" class — because as we all know, money can't buy class. Just ask Paris Hilton's brother, who thinks we're all a bunch of f*cking peasants (His words, not mine.)

One economist, Noah Smith, recently wrote at Bloomberg: "A plurality of Americans still consider themselves middle-class.” (A plurality meaning, more than any other, but not an absolute majority.) But he linked to The Guardian to make his case, which appears to be saying something completely different:

The number of 18-29 year olds who consider themselves lower-middle-class has doubled since 2008 reaching 49% ... Average household income hovers around $51,700 – which is how much Americans were earning back in 1995. Yet even as 14.5% of Americans meet the actual definition of living in poverty, only about 7% of them will define themselves as lower-class. The definition most of them prefer is lower-middle-class. According to the Pew Research Center, the number of those who define themselves as lower-class or lower-middle-class has gone up to 40% in 2014, increasing by 15% since 2008 ... In 2008, 21% of [wealthy individuals] identify as in the upper-class or upper-middle-class. Even Hillary Clinton, who reportedly made over $100 million along with her husband President Bill Clinton since leaving the White House, said that she didn’t consider her family as being "truly well-off".

Noah Smith also believes if you think “I’m doing OK, and most people around me are doing OK too” — then you’re in the middle-class. He also links to Ezra Klein at VOX, who recently wrote:

There's no analogous middle-class line. In the New York Times, [they] try to create one, defining middle-class as households making more than $35,000 and less than $100,000. Using this definition shows that the ranks of the middle-class have been thinning for decades ... "Although many Americans in households making more than $100,000 consider themselves middle-class, particularly those living in expensive regions, they have substantially more money than most people."

Ezra Klein also says, "Middle-class is, in some ways, a state of mind, or at least a state of comfort." He links to a New York Times poll which shoes that 38 percent of Americans considered themselves middle-class. (This might be the "plurality" Noah Smith was referring to.) But almost as many — 33 percent — considered themselves working-class. And another 12 percent thought they were upper-middle-class.

On the extreme peripheral of this debate (as to what defines middle-class), Stephen Moore at the Heritage Foundation (when discussing the inheritance tax while defending spoiled rich kids) actually used the term middle-class when referencing a $5 million tax exception in the same sentence — as though trust-fund babies and middle-class workers were one and the same.

But if by using the New York Times' definition for what might be considered middle-class (those earning more that $35,000 a year, but less than $100,000), then according to Social Security data for wage earners, then 34.5 percent earn a middle-class wage.

58.5 percent earn $35,000 or less

34.5 percent earn between $35,000 and $100,000

6.9 percent earn $100,000 or more

But who can seriously believe that $35,000 a year (especially when compared to other incomes) is a reasonable middle-class income? Can one pay a mortgage, make a car payment, raise two children, save enough for college and also plan for a modest retirement — all on a mere $35,000 a year? A more reasonable assumption might be (at very least) $50,000 a year before payroll taxes — in which case, only 19.4 percent of all wage earners would generate a true middle-class income — meaning most others don't even come close. Whether they admit it to themselves or not, they are either lower-middle-class, lower-class, or poor. (And for the sake of argument, for a dual-income household — if each wage earner were making $50,000 a year — only then might we assume this to be an upper-middle-class household.)

The "headline news" that's reported by the media (per the Bureau of Labor Statistics) is that the "average" hourly wage is now $24.75 an hour as of January 2015. That would indicate that the average American worker is earning a respectable and average middle-class wage — but this is a "mean" wage (an average), not a "median" wage.

The BLS also reports: "The median weekly earnings of the nation's 107.4 million full-time wage and salary workers were $799 in the fourth quarter of 2014" — but assuming $24.75 an hour (for what the BLS says is an average work-week), a 40-hour week would gross at least $955.35 a week — just shy of $50,000 a year. In which case, that would also indicate that the average American worker is earning a reasonable and average middle-class wage.

But getting back to Noah Smith (at Bloomberg), he goes on to say:

That’s why inequality kills the idea of a middle-class, even if it improves people’s standard of living overall. When everyone makes $50,000 a year, it’s easy to tell that you’re middle-class. If half of those people suddenly start making $150,000 a year, it’s no longer so easy. For the half of people still making $50,000, nothing has changed in terms of their absolute material standard of living — they still have the same number of cars, TVs, etc. But now they might think to themselves, “Have I failed in some way? Why am I still making $50k when half of the people in the neighborhood are making three times as much as I am?”

That almost sounds as though he were making some assumptions based on class envy — the Joneses vs the Smiths. But regardless, that's also where his logic breaks down. First, half of all workers don't earn anywhere near $50k a year; and second, even most "households" just barely passes that $50k benchmark. Based on a 40-hour work week, someone earning $24.75 an hour (the "average") would have an annual income of $51,480. But according to most recent data, Sentier Research shows the annual "median household" income to be $54,417 — and most households have dual- or multiple-income households.

These incomes can either be derived solely from wage earners (hourly or salaried), or from a combination of several other scenarios: a wage earner with another wage earner, or in conjunction to someone with earnings from other sources (other than wages), such as from Social Security, disability insurance, pensions, 401ks, unemployment benefits, capital gains earnings (e.g. stock-options, real estate, SWAG investments, etc.), trust funds, annuities, royalties, rents, dividends, lottery winnings, consulting fees, commissions, rewards, finder's fees, legal settlements, life insurance, patents, etc.

The vast majority of all households get their income from two or more incomes — and the "median" annual household income of $54,417 if divided by two incomes would be $27,208 — which is very close to what the Social Security Administration last reported as the annual net "median" income for all wage earners — which is $28,031 a year. SSA reported "66.9 percent of wage earners had net compensation less than or equal to $43,041.39 (which is the "raw average wage").

It's rarely differentiated in the media (and glossed over by BLS numbers) the meaning of "average" and "median" — and it's never empathized, that most wage earners rely on someone else's income to share household expenses. It's more expensive (and can be a luxury) to live alone. Some of our the most wealthy citizens own multiple homes, and many times occupy them only a few days a year (while hundreds of thousands remain homeless).

The two-income household is now the common default for most Americans. Elizabeth Warren co-authored the book The Two-Income Trap: "Today's two-income family earns 75% more money than its single-income counterpart of a generation ago, but has 25% less discretionary income to cover living costs ... The ferocious bidding war for housing and education has silently engulfed America's suburbs, driving up the cost of keeping families in the middle-class."

Yes, in most cases, the two-income household has arisen primarily for economic necessity — and not because poor people were trying to keep up with the Joneses (or because they envied the rich). Many households today simply cannot get by on one income (And maybe why about 7.2 million wage earners also hold multiple jobs). The decline of the middle-class household would be more dramatic if it were not for the emergence of the dual-/multiple-income and/or multiple job holder household. Many young Americans have no choice but to live in households with multiple streams of income (and why 55.3% of them still live with their parents).

Inflation: Primarily because of this destruction of purchasing power, a single-income household in 1970s was better off than a dual-income household in the 2000s. While the nominal amount of income for a dual-income household is higher, fixed costs are also much higher. In fact, the household in the 1970s had more disposable income adjusting for inflation than the dual-income household of today. Given that the 2000s were the decade of the real estate bubble, many of the jobs that were lost after the crash came from fields where the majority of workers were men (i.e., construction, etc). Because of this shift after the recession, men and women are now nearly equally represented in the workforce.

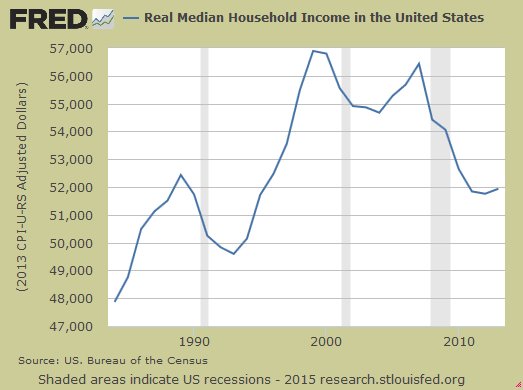

Many households have but no choice but to have two or more workers. The fact that the Social Security data shows that the median per capita wage is $28,031, it's then do we begin to realize that many Americans (i.e. Mitt Romney's 47%) are simply treading water. The two-income trap is real — and has only become a larger phenomenon after the financial crisis of the Great Recession. If we look at household income, adjusting for inflation, it is back to where it was nearly a generation ago. (As of February 6, 2015 the BLS reports the U.S. had 147.7 million households.)

Adjusting for inflation, real median household income is now back to where it was in the late 1980s. From a recent study at VOX: "In the 1980s, incomes of the high-saving rich soared, while those of the middle-class stagnated. So the rich lent their ‘increased’ savings to the middle class, who used the funds to maintain their consumption growth and speculate in real estate. Initially, all was well, as the real estate boom propelled a construction-based expansion. But by 2007, the music had stopped."

As of 2007 (just for married couples) 67 percent were in dual-income households. This is a monumental jump from the more "conservative" days of "Leave It to Beaver", "I Love Lucy" and "Father Knows Best".

Now, try saving for college today — with tuition fees and housing costs surpassing $25,000 a year — especially when you are only earning $54,417 a year OR LESS as an entire multiple-income household (the median) or only taking home a mere $28,031 a year OR LESS as an individual (the median). It's no wonder student debt is now over trillion dollars today. The average student will graduate with $26,600 of student debt — about equal to the annual median income of American workers.

Noah Smith closes his post with, "The middle-class is dead. There is no going back in our lifetimes. We need to find a new way of thinking about broadly shared prosperity." (Like helicopter drops?)

* SUB-NOTE: Here's a simple example of the difference between a "median" and "average" wage: Take the value of 3 wage earners: one earns $7.25/hr (a minimum-wage fast-food worker), the second one earns $24.75/hr (a union factory worker earning the "average" wage) and the third one earns $150/hr (a former member of Congress-turned lobbyist). This would make the "median" wage $24.75/hr (the number in the middle) — half those workers earn more, and the other half earns less. Whereas, if you add all three of their wage values together, then divided them by 3, you'd get an "average" wage of $60.66/hr. There is a HUGE difference between "average" wages and "median" wages. So the next time, when the media says the "average" worker is making a whopping $24.75 an hour, don't feel too bad — because "averages" are skewed my higher income earners. Social Security also reported 110 people with wages over $50 million (although, we can assume that most of their income was "unearned income" in the form of capital gains).

UPDATE:

ReplyDelete"The cost of living for one person in the U.S. is $20,194. After taxes and living expenses, most Americans are just getting by. For those in more expensive cities like New York or Washington DC, people with low wages are barely surviving. Our minimum wage really should be about $22 per hour...The minimum wage from the 1960’s would be $22 in today’s productivity terms."

http://economyincrisis.org/content/income-inequality-is-ravaging-americas-middle-class

American workers can no longer afford to save money for a rainy day either. CEPR: "The current saving rate is far below the average for the 1960s, 1970s, and 1980s."

http://www.cepr.net/index.php/blogs/beat-the-press/actually-the-personal-saving-rate-is-very-low