Venture capitalist Nick Hanauer is a very wealthy man and a part of the top 0.01%. But even though he is very rich, he's much different than the plutocrats that dominate America today.

Nick Hanauer was the first outside investor in Amazon.com (which went online in 1995) — and one reason why Amazon is currently located in Hanauer's hometown of Seattle, Washington.

He was also the founder and chairman of Aquantive Inc., which was sold to Microsoft in 2007 for $6.4 billion in cash. Some of his other investments included Insitu Group (purchased by Boeing for $400 million) and Market Leader (purchased by Trulia in 2013 for $350 million).

Most of America's mega-wealthy oligarchs (who dodge billions of dollars in taxes, offshore millions of good-paying jobs and hoard trillions of dollars in profits in offshore banks) have hired journalists and economists to make their case that they can't afford to pay higher taxes or offer higher wages to their employees. But of course, one wouldn't think so if they looked at how they paid themselves.

They also give political candidates millions of dollars to make sure that their taxes don't go up — but instead, try to cut them even more. And some of these rich social psychopaths also want to eliminate the federal minimum wage altogether. Not to mention, weaken labor and worker safety laws, skirt environmental regulations and ban labor unions. The more radical among them would also eliminate the IRS (maybe to escape from being audited).

But Nick Hanauer is much different. And unlike many of these other multi-billionaires, he doesn't consider himself a "job creator" per se. He reasons that if no one can afford to buy what he's selling, then the jobs his companies create will disappear. In his view, what the nation needs now is more money in the hands of regular consumers and more infrastructure investment. That's why he advocates for raising taxes on the rich and hiking the minimum wage.

- Nick Hanauer at Bloomberg (November 2011) Raise Taxes on Rich to Reward True Job Creators

- Nick Hanauer at Bloomberg (June 2013) The Capitalist’s Case for a $15 Minimum Wage

He also thinks that American corporations should stop manipulating their stock prices just to further enrich the top 0.01% (as though they weren't already rich enough).

Nick Hanauer in his Seattle office.

In a recent interview at Bloomberg, Nick Hanauer notes (4:10 into the 7:23 video) that in 1982 Ronald Reagan put a Wall Street CEO in charge of the SEC who changed the rule that allowed publicly traded companies to buy back their outstanding shares of company stock. Before that, it was considered "stock manipulation" — and illegal.

That SEC rule change coincided with stock-based compensation for company executives, when the single-minded goal was pumping up stock prices. These execs would write pay packages for themselves (almost everyone on the board of directors) that included stock-options grants — and then followed this up with large stock buy-backs.

Nick Hanauer said to help solve this, the rule should be changed to give incentives to companies to reinvest in R&D, employees and company expansions — rather than just incentivize companies to enrich their biggest share holders — such as company execs and institutional shareholders. (But as Rolling Stone noted in 2013, when Obama appointed Mary Jo White to be the director of the SEC, it was like putting the fox in the hen house).

This, from an excellent article at the Roosevelt Institute about stock buybacks:

* SEC Chairman John Shad, who had previously been a top executive at the Wall Street investment bank E. F. Hutton, was an advocate of the rule change. He argued that large-scale open market purchases would fuel an increase in stock prices that would be beneficial to shareholders. [John Shad died in 1994. His bio is at the New York Times.]

* Under the Securities Exchange Act of 1934, large-scale stock repurchases can be construed as an attempt to manipulate a company's stock price. In November 1982, however, SEC Rule 10b-18 changed all that. The new rule provided companies with a safe harbor that assured them that manipulation charges would not be filed if each day's open-market repurchases were not greater than 25% of the stock's average daily trading volume for the previous four weeks and if the company refrained from doing buybacks at the beginning and end of the trading day."

* Section 10(b) is codified at 15 U.S.C. § 78j(b) — Rule 10b-5 has been employed to cover insider trading cases, but has also been used against companies for price fixing — artificially inflating or depressing stock prices through stock manipulation.

In his interview at Bloomberg (video below) Nick Hanauer explains why wages need to be higher: to drive consumer demand, to drive U.S. economic growth, to drive American companies to expand their businesses — rather than just artificially pumping up their stock prices by buying back company shares.

- The Economist: "The companies in the S&P 500 index bought $500 billion of their own shares in 2013."

- Bloomberg (2014) S&P 500 Companies Spend Almost All Profits on Buybacks: "They’re poised to spend $914 billion on share buybacks and dividends this year, or about 95 percent of earnings."

As NoBillionaires.Com noted, Nick Hanauer had also previously made a valid point during a TED talk when explaining why rich people aren’t really the true "job creators":

“There can never be enough super-rich Americans to power a great economy. The annual earnings of people like me are hundreds, if not thousands, of times greater than those of the median American — but we don't buy hundreds or thousands of times more stuff.” (Video and full text of speech here.)

Recently Nick Hanauer and David Rolf (president of the Seattle-based local of the Service Employees International Union), co-authored an article titled Shared Security, Shared Growth:

"But by far the biggest threat to middle-class workers — and to our economy as a whole — comes from the changing nature of employment itself. Gone is the era of the lifetime career, let alone the lifelong job and the economic security that came with it, having been replaced by a new economy intent on recasting full-time employees into contractors, vendors, and temporary workers. It is an economic transformation that promises new efficiencies and greater flexibility for “employers” and “employees” alike, but which threatens to undermine the very foundation upon which middle-class America was built. And if the American middle-class crumbles, so will an American economy that relies on consumer spending for 70 percent of its activity." (Check out the reader comments at Mark Thoma's blog)

The Atlanta Fed's most recent outlook: "The elevated share [of part-time workers] is concentrated among people who would prefer to be working full-time." Their main reasons were: 1) The relative cost of full-time employees. 2) Lack of strong enough sales growth to justify conversion of part-time workers to full-time workers. [Editor's Note: In case you missed that, "sales growth" = extra money in people's pockets to spend. That's what Nick Hanauer has been

saying.]

Employers' predictions for part-time employment at their firms:

* About 27 percent believe that in two years their firms will be more reliant on part-time work compared to before the recession.

* About 7 percent do not currently have an elevated share of part-time employees, but believe they will in two years.

* About two-thirds believe their share of part-time will be roughly the same as before the recession.

* Only 8 percent believe they will have less reliance on part-time workers compared to before the recession.

The Atlanta Fed concludes (without the links):

"Low sales growth and an ample supply of workers willing to take part-time jobs could both be viewed as cyclical factors that will dissipate as the economy further improves. Meanwhile, higher compensation costs of full-time relative to part-time employees and the role of technology that enables companies to more easily manage their workforce can be considered structural factors influencing the behavior of firms. Firms that currently have a higher share of part-time employees gave about equal weight to these forces, suggesting that, as other research has found, both cyclical and structural factors are important explanations for the slow decline in the part-time share of employment."

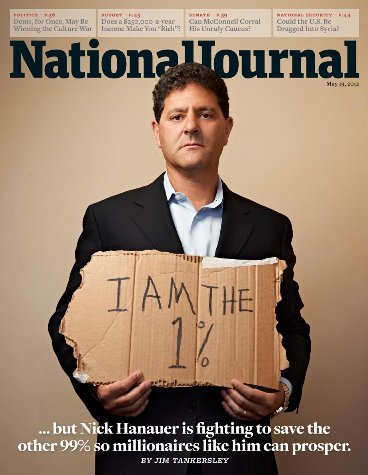

The National Journal: The 1 Percent Solution — "Nick Hanauer is the kind of innovator and venture capitalist expected to power the country’s next wave of growth. So why does he insist that only the fading middle-class can rescue America?"

Also read Nick Hanauer's related post at Politico: The Pitchforks are Coming… for Us Plutocrats — "Seeing where things are headed is the essence of entrepreneurship. And what do I see in our future now? I see pitchforks."

New IMF research shows that income distribution itself—not just the level of income inequality—matters for growth:

ReplyDeletehttp://blog-imfdirect.imf.org/2015/06/15/growths-secret-weapon-the-poor-and-the-middle-class/

"Specifically, we find that making the rich richer by one percentage point lowers GDP growth in a country over the next five years by 0.08 percentage points—whereas making the poor and the middle class one percentage point richer can raise GDP growth by as much as 0.38 percentage points. Put simply, boosting the incomes of the poor and the middle class can help raise growth prospects for all. One possible explanation is that the poor and the middle class tend to consume a higher fraction of their income than the rich. What this means is that the poor and the middle class are key engines of growth. But with inequality on the rise, those engines are stalling. Over the longer run, persistent inequality means that the the poor and the middle class have fewer opportunities to get educated, enhance their skills, and pursue their entrepreneurial dreams. As a result, labor productivity and growth suffer."

Just like Nick Hanauer says, if you put more money in people's pockets, they'll spend more. Maybe that's the whole premise of "supply and demand" --- but where "demand" comes before "supply". Because, as Nick says, the rich don't buy 1,000 times more shirts just because they make 1,000 times more money. Who would have thought ... go figure ;)

The Federal Reserve Bank of San Francisco (June 29, 2015) The Stimulative Effect of Redistribution ("Conclusion: Surveys show low-income households tend to spend a larger share of their income than high-income households. Because of this, temporarily redistributing income from the rich to the poor could stimulate consumption and, through that, the economy as a whole."

ReplyDeletehttp://www.frbsf.org/economic-research/publications/economic-letter/2015/june/income-redistribution-policy-economic-stimulus/

The right-wing/conservative/Republican/GOP/Tea Party economists at their Koch-brothers funded think tanks always use the top 10% to shield the top 0.01 percent, when it's the top 0.01 percent who are the ones making all the extra money. Whereas most of the top 10% are subsidizing family members who are in the lower decile brackets. If you want to redistribute and show a real effect, just redistribute from the top 0.01 percent — not from the top 10%.

Professor Emmanuel Saez (June 29, 2015) "The top 1 percent of families captured 58 percent of total real income growth per family from 2009 to 2014, with the bottom 99 percent of families reaping only 42 percent."

ReplyDeletehttp://equitablegrowth.org/research/u-s-income-inequality-persists-amid-overall-growth-2014/

Jeff Bezos is the libertarian owner of Amazon who bought The Washington Post last year.

ReplyDeleteEarlier, the Washington Post (June 9, 2015) asks, "Why don’t voters demand more redistribution?"

In the article the authors make the argument that the reason we don't demand more redistribution (aka “tax increases” and “wage increases”) is because, not only are we stupid (because many of us are), but also because we don't believe in redistribution, and because we love and admire the rich.

"Opposition to redistribution is partly rooted in the fact that few American voters consider themselves poor or working class, and even fewer understand just how much more money the wealthy have than they themselves do [and] some poor voters oppose Robin Hood policies because they believe capitalism is fair and the rich should be respected, not resented, for their efforts and achievements. Others hold that even though they might be poor in the present, they might be rich in the future, and that people get what they deserve in life and shouldn’t ask for a handout."

http://www.washingtonpost.com/blogs/monkey-cage/wp/2015/06/05/why-dont-voters-demand-more-redistribution/

Brigham Young University: "The majority of the United States' poor aren't sitting on street corners. They're employed at low-paying jobs, struggling to support themselves and a family. "

ReplyDeletehttp://www.eurekalert.org/pub_releases/2015-06/byu-moa062515.php