[* Editor's note: This post also contains some good tid-bits from TooMuchonLine.Org]

According to Forbes magazine, in 1982 Forbes began its annual top 400 list when the 400 richest Americans (in today’s dollars) averaged $570 million each. Today they average $5.8 billion each. (Donald Trump ranks #121)

To make the Forbes list of America’s 400 richest in 2015, you'd need a fortune worth at least $1.7 billion. That threshold, the highest ever, has denied 145 other U.S. billionaires from being included in this year’s Forbes 400.

To the obscenely rich, it's just like a game of Monopoly™ for them — because, of course they don't need the money; they just want on the stupid list. And they'll do whatever it takes: cut wages, offshore jobs, and bribe politicians to lower their tax rates and pass laws that are the most favorable to them. They can never be rich enough or too rich, almost as though their pursuit of wealth was an addiction or mental illness.

"Wealth is like sea-water; the more we drink, the thirstier we become; and the same is true of fame." — Arthur Schopenhauer

A recent study by Emmanuel Saez and Gabriel Zucman shows that between 1982 and 2012, households in America’s bottom 90 percent saw their average net worth (after taking inflation into account) increase less than 1 percent per year — all while the rich got much richer.

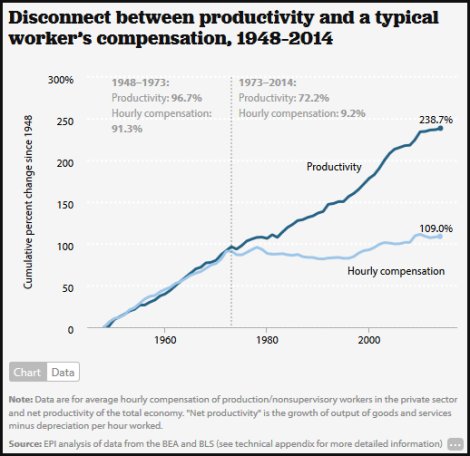

According to a new report from the Economic Policy Institute, between 1973 and 2014, productivity in the United States jumped 72.2 percent. But hourly worker compensation nudged up just 9.2 percent. If increases in hourly pay had matched increases in productivity, the U.S. would have seen no rise in income inequality since 1973. But since 1973, hourly compensation of the vast majority of American workers has not risen in line with economy-wide productivity. In fact, hourly compensation has almost stopped rising at all.

Recently in a speech about racial injustice at the Edward M. Kennedy Institute, Senator Elizabeth Warren noted:

"Republicans’ trickle-down economic theory arrived. Just as this country was taking the first steps toward economic justice, the Republicans pushed a theory that meant helping the richest people and the most powerful corporations get richer and more powerful. I’ll just do one statistic on this: From 1980 to 2012, GDP continued to rise, but how much of the income growth went to the 90% of America — everyone outside the top 10% — black, white, Latino? None. Zero. Nothing. 100% of all the new income produced in this country over the past 30 years has gone to the top ten percent."

Meanwhile, just the top 25 U.S. hedge fund managers currently take home more income than all the kindergarten teachers in America combined. Why is corporate executive compensation soaring while worker pay stagnates?

In a nutshell: For the past 40 years (so the Millennials couldn't remember how it used to be) most of all the gains from the productivity of America’s workers have been going to America’s bosses. But most of this has now become common knowledge, so there are no surprises here.

But how did our most fabulously rich manage to multiply their wealth ten times over while average Americans barely broke even? How do our billionaires make their billions? Business analyst Sam Wilkin offers up the scoop in his new book: Wealth Secrets of the One Percent: A Modern Manual to Getting Marvelously, Obscenely Rich

|

|

In an interview with Sam Pizzigati (the editor of TooMuchOnline.Org) Sam Wilkin says:

|

The problem with over-the-top CEO pay goes far beyond the sheer immensity of the mega millions CEOs are collecting out of corporate coffers. The even bigger problem — for average workers — remains what CEOs are doing to claim those mega millions.

A Cornell Study shows that paying CEOs fat bonuses for stock performance doesn't work. The analysis examined a decade’s worth of data from every company in the S&P 500. It compared companies that offer their top brass a total shareholder return plan to those that don’t, and found the increasingly popular pay plans haven't significantly boosted any of a number of key metrics."

Most corporations tie CEO compensation to their share prices (earnings-per-share) or some other “performance” metric. The outrageously high rewards top execs collect when they hit their targets on these metrics give the execs an irresistible incentive to behave outrageously. Average workers bear the brunt of that outrageous behavior. They see their jobs downsized, outsourced, or turned into part-time employment — and they see their wages stagnate (or even decline when adjusted for inflation).

Meanwhile, the rich get richer.

A newly released study by Notre Dame business school researchers show that corporations that lavish stock options on their top executives also expose their customers to more unsafe products. The study traced the pay and performance of 386 CEOs over eight years. Hefty option grants, the researchers suggest, give CEOs an incentive to take risks because they benefit enormously from future increases in share prices — but lose nothing if share prices tumble.

Also, new research from Wallet Hub show that Americans in the top 1 percent pay state and local taxes at about half the rate that middle- and low-income Americans pay — and that most Americans believe that rich households making over $2.5 million a year should be paying three times more of their income in state and local taxes than families making $30,000 a year.

A recent report from a Thomas Piketty protégé (Gabriel Zucman) shows tax havens hide $7.6 trillion — about 8 percent of the world’s net financial wealth. For individuals, he estimates at least $2 trillion held in Swiss banks is still undeclared by account holders to their home countries. Zucman’s calculations are conservative because he can’t count assets like art, jewelry or real estate. Those trillions were missing because they were showing up as shares of mutual funds incorporated in tax havens, primarily in Luxembourg, Grand Cayman and Ireland. His theory: wealthy investors around the world have used the investments, often made through Swiss bank accounts, to hide their wealth.

In a new paper titled Stealth Politics by U.S. Billionaires (September 2015) Benjamin Page, Jason Seawright, and Matthew Lacombe write for the American Political Science Association: “The poorest billionaire has more than one hundred times the wealth of the poorest one-percenter.”

That helps explain why these researchers have trained their sights on how America’s 100 top billionaires — whose combined wealth of $1.3 trillion — go about practicing politics. The vast majority give generously to both candidates and political organizations. Salon: How our tight-lipped overlords are waging stealth campaigns against the middle class:

"These billionaires deliberately pursue the strategy we are calling stealth politics, attempting to influence public policy in directions not favored by average Americans while avoiding public statements about policy."

Sociologists at Yale University’s Institute for Network Science have found that the more the rich flaunt their wealth, the more the social fabric tears. The study shows that wealthy people who find out that their neighbors don’t have the resources they do, become less likely to help them — or anybody else for that matter.

Conclusion (A moral and spiritual commentary):

In a nutshell, too many of the fabulously wealthy (with no regard for anyone else but themselves) work us to death, pay us very little, cheat and bribe our elected officials to get what they want (no matter how dangerous it is to us or the economy). Then they insult and demean everyone else, all while bragging about their great wealth as they're rubbing it in our face.

"Power tends to corrupt, and absolute power corrupts absolutely. Great men are almost always bad men." — Lord Acton

Some of the ancient rulers of Rome and Egypt believed they were living gods. Those may be our "captains of industry" — our "business leaders" — our "job creators" today in the 21st century. We are a nation of "leaders" with no moral compass (The Pope, the US and the Golden Calf).

Will they go to Hell? Ask anyone who has spent just one day in jail. It can be Hell. If you kill someone, you can spend the rest of your life in this Hell. Then after you die (whether you believe it or not), you will spend an eternity in the real Hell — possibly suffering unimaginable pain while burning in Hell fire...

Or, you might exist in total blackness for eternity, devoid of any pain at all — but without any sight, sound, hearing taste, smell or touch. Ask anyone what it's like who spent just one hour of sense deprivation — or what's it's like to spend just one day in solitary confinement. After several months or years, they go insane.

Earth is only 4.5 billion years old. Now imagine an eternity of extreme pain and/or insanity. Is it worth going to Hell to kill someone for $20 worth of crack — or because your mate/spouse/partner might have cheated on you? Would it be worth it to pursue several billion dollars (to the detriment of others) just to be on the Forbes 400 list? Is that worth going to Hell for?

And why can't the unemployed poor, the working poor, and what's left of the middle-class correct income inequality? Because many people in Congress (and a couple on the Supreme Court) are just as corrupt as some of those on the Forbes list — and half the members of Congress are millionaires themselves and pass laws that mostly benefit the rich. So it's the fox guarding the hen house. So IMHO, many of them will most likely go to Hell too.

|

Related articles:

- The 1 Percent’s Houses Are Getting Bigger and Swankier While Average Americans Struggle To Make Rent

- Pope Francis, Bernie Sanders and the moral imperative of systemic change

- Poor People Don't Have Less Self-Control. Poverty Forces Them to Think Short-Term.

Stephen Hawking Says We Should Really Be Scared Of Capitalism, Not Robots:

ReplyDeleteMachines won't bring about the economic robot apocalypse -- but greedy humans will, according to physicist Stephen Hawking.

"If machines produce everything we need, the outcome will depend on how things are distributed."

http://www.huffingtonpost.com/entry/stephen-hawking-capitalism-robots_5616c20ce4b0dbb8000d9f15