And it's mostly for a lack of jobs, not because old people are retiring. That's why young people should join a political revolution.

Reuters just reported (December 24, 2015) "The number of Americans filing for unemployment benefits fell more than expected last week, nearing a 42-year low as labor market conditions continued to tighten in a boost to the economy." The St. Louis Federal Reserves shows that initial claims for jobless benefits are indeed at historic lows, but not for the reason Reuters or others in the media claim.

The media is total B.S — The number of jobs created haven't kept up with the number of high school and college grads. Just because less people are receiving jobless benefits doesn't mean more people are finding jobs — or that less people are unemployed.

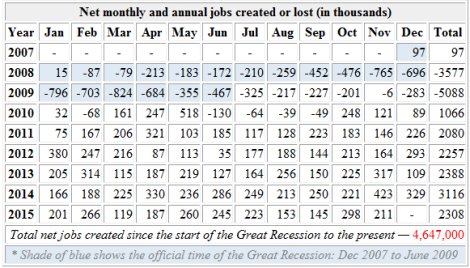

Although the Great Recession didn't officially start until December 2007, the Bureau of Labor Statistics didn't begin showing consecutive monthly job losses until February 2008, lasting until December 2009 (over a period of 23 continuous monthly losses) totaling over 8 million. Last year in 2014 it was reported by the L.A. Times (among other media outlets) that the economy recovered all 8.7 million jobs lost during the Great Recession (which officially ended in June 2009).

But since the recession ended, according to the National Center for Education Statistics (NCES), we've also averaged over 3 million high school grads every year, and/or college grads, because the majority of high school grads have gone on to college and graduated. It was last reported by the Bureau of Labor Statistics that 68.4 percent of 2014 high school graduates were enrolled in colleges or universities.

As the National Employment Law Project (NELP) reported, federal extended benefits ended in December 2013 — so millions more would have exhausted State benefits and would have been on the federal program, but weren't (and not because they all found jobs). According to a White House report, from July 2008 to December 2013, we had a whopping 24 million long-term unemployed workers who once received these federal extended jobless benefits.

Since the recession ended (per Arthur Delaney at the Huffington Post), fewer and fewer people received jobless benefits because many States have enacted laws shortening the duration for regular State benefits. So between that and the elimination for the federal extended program, many more jobless people who would otherwise be receiving benefits, were not.

Since the Great Recession officially ended, more and more people have "dropped out" of the labor force" after their jobless benefits were exhausted — when hey couldn't find a job — and now they are no longer counted as unemployed. According to the Bureau of Labor Statistics, just since the Great Recession officially began in December 2007, we've had 15.2 million Americans who have left the labor force for various reasons.

According to data provided by Social Security, since December 2007 to the present (over the past 8 years) we've had an additional 8.5 million Social Security retirees and 1.8 million "disabled workers" on Social Security disability — for a total of 10.3 million, subtracted from 15.2 million who left the labor force = a 4.9 million balance (even though all those who receive Social Security benefits don't leave the work force). The Bureau of Labor Statistics currently reports that there are 5.6 million working-age Americans who are "not in the labor force, want a job now".

So it's no wonder the media is reporting that unemployment claims are at a 42 year low. But that doesn't mean more people are finding jobs or less people are unemployed — and that the economy is any better today than it was in October 2009 when the Bureau of Labor Statistics had reported: "In October, the number of unemployed persons increased by 558,000 to 15.7 million. The unemployment rate rose by 0.4 percentage point to 10.2 percent, the highest rate since April 1983."

Currently the Bureau of Labor Statistics reports 7.9 million are unemployed. But if you add the 4.9 million who dropped out of the labor since 2009 (and didn't retire or go on disability), we still have almost as many people unemployed today as we did at the height of the Great Recession — which is the number of people unemployed during the height of Great Depression in 1933 — when nearly 25% of the U.S. work force was unemployed — or almost 13 million people.

Per the Bureau of Labor Statistics (see the chart below), since December of 2007 (at the start of the recession) until to the present, 4.7 million net new jobs were created. During that same period of time, NCEC reports that for the graduating classes years 2008 through 2015 (over 8 years) we've had a least 24 million new high school/college graduates.

If 8.7 million jobs were lost, but gained back during that time — presumably to re-employ the 8.7 million people who lost jobs during the recession (minus those who retired, went on disability and passed away), then 4.7 million net new jobs were created for 24 million new graduates who were first attempting to enter the job market. Is that why the unemployment rate for youth is so much higher than the rest of the population? As of November 2015 their unemployment rate is 11.2% compared to 5% for all who are unemployed.

The St. Louis Federal Reserve shows that from the start of the Great Recession to the present, the labor force participation rate for those:

- 16 to 19 years-old has fallen from 41.2% to 33.5% (includes high school grads and dropouts)

- 20 to 24 years-old dropped from 74.1% to 70.5% (includes high school and college grads)

- 25 to 54 years-old fell from 83.3% to 80.8% (known as prime age workers)

But despite the 10.3 million people who went on disability and retired from December 2007 to the present (which are usually older workers), the labor force participation rate for older workers (55 years-old and older) went up from 38.9 to 40% — so we can't blame the Baby Boomers for the falling labor force participation rate, because the first Boomer didn't retire until 2008 (early, at the age of 62) and the labor force has been in a long and steady decline since 2000 (about the time when Bill Clinton gave PNTR to China). But the media keeps claiming that an older work force (and not unemployed youth) is driving the decline — which is total B.S. — because older workers are working longer.

We currently have 22.2 million young people age 16-24 years old in the civilian non-institutional population — and of those, 14.5 million are not working; and of the 7 million who are working, most are working part-time. (*Subtract what you will for minors still dependent on their parents or guardians and still in high school.)

22,187,000 total 16-24 year-olds in the civilian

non-institutional population

− 1,389,000 working full-time

− 5,625,000 working part-time

= 15,173,000 not working at all

− 670,000 counted as "unemployed"

(because they say

they are looking for full or part-time work)

= 14,503,000 not working at all and not counted as part of the labor force.

Per NCES: We had 3.3 million young people graduating from high school for the 2015/16 year. But Fed Chairperson Janet Yellen claimed that only 1.2 million jobs a year will be needed for first-time job seekers (100,000 a month). But even if all 3.3 million people graduating from high school went straight into college (and didn't work at all), we'd still have that many graduating from college to look for a job.

Yellen also made the "old" claim that an aging population is reducing the labor force — even though high school/college grads out-number Social Security retirees by 3 to 1 (There were 1.1 million retirees last year).

Yellen also blamed an older work force for a decline in the labor force participation rate — but older people are working longer (55 years and older), and their labor-force-participation-rate has been increasing since the 1990s (as cited by the St. Louis Fed) — and decreasing for prime-age workers ages 25-54 years old (also cited by the St. Louis Fed).

Meanwhile remember, just since the Great Recession officially began in December 2007, we've had 15.2 million Americans who have left the labor force — and of those, 5.6 million want a job now. And that doesn't include the 7.9 million who are unemployed, still in the labor force, reported as "unemployed", and most likely want a job too.

Yellen also said: “I don’t think we should expect to see labor-force participation move up a great deal over time.” But the BLS and the Fed have long ago predicted a further decline going into 2022 — so that's not news.

The decline in the labor force and the very high unemployment rate for young people is because of offshoring. The U.S. has lost 67,161 factories since 1997 — for a loss of over 5 million (mostly union) manufacturing jobs (directly), plus the loss of their "multiplier effect" — only to be partially replaced with part-time, temp and low-paying jobs in the service industry.

Economic Policy Institute (EPI): "The decline of manufacturing in the United States over the past 15 years has been well documented: 5.4 million manufacturing jobs [the same exact number who say they want a job today] and over 82,100 manufacturing establishments were lost between 1997 and 2013. There is a common (but incorrect) idea that high wages in U.S. manufacturing are causing growing job losses and declining U.S. export competitiveness ... The decline of American manufacturing over the past 15 years is due to currency manipulation and unfair trade, and not high wages."

[I'm not sure where EPI got their number of 82,100, but I got mine (67,161) from the Bureau of Labor Statistics. But either way, it's still a lot.]

Since December 2007 (the start of the Great Recession) to the present (over the past 8 years) we've had:

ReplyDelete* An additional 8.5 million Social Security retirees

* An additional 1.8 million "disabled workers" on Social Security disability

* An additional 15.2 million who left the labor force

* An additional 24 million high school/college graduates

* An additional 4,647,000 "net new jobs" created + the jobs lost during and after the recession officially ended

========= In other News =========

ReplyDeleteLouisiana’s board of education is going to implement a new policy which requires all high school students to fill out a Free Application for Federal Student Aid in order to receive a high school diploma. Think about that for a moment. In order to receive a diploma, the State of Louisiana is requiring that high school seniors fill out an application which would enable them to go into debt the moment they receive their diploma. As it it is now, many college grads are taking jobs that don't require a college education, displacing high school grads and dropouts.

Via the U.S. News and World Report:

http://www.usnews.com/news/articles/2015-12-22/louisiana-to-require-students-to-fill-out-fafsa

Related post at ZeroHedge:

http://www.zerohedge.com/news/2015-12-27/atlas-shrugged-er-government-now-preying-high-school-graduates

========= In other News =========

The State minimum wage is going up in 14 States in 2016

http://www.huffingtonpost.com/entry/minimum-wage-2016_5679d096e4b06fa6887f4276

========= In other News =========

Dec. 27, 2015: For years, many homeless people have spent the night in airports between when the last evening flight lands and the first morning flight departs. But in a number of cities across the country, officials are now cracking down on that unspoken arrangement. As the number of homeless people has climbed in major metropolitan areas like Washington DC and New York City, there’s anecdotal evidence that the ranks of people sleeping in airports has similarly grown. One individual, according to Bloomberg, has even lived in LaGuardia for 20 years.

http://www.theguardian.com/us-news/2015/dec/27/airports-homeless-people-crackdown-new-rules

(* MY NOTE: If someone bought an open round-trip ticket to Anywhere, USA -- could they still be kicked out of an airport?)

========= In other News =========

The Guardian: "$100,000 and up is not enough — even the "rich" live paycheck to paycheck. Private schools, divorce and basic necessities — about 25% of people making six-figure salaries say they are struggling.

http://www.theguardian.com/business/2015/dec/25/wealthy-americans-living-paycheck-to-paycheck-income-paying-bills

(My comment at The Guardian)

It seems as though those in the upper income brackets are more prone to living beyond their means ... more so than poor people.

And why did the Guardian use quotation marks in the title around the word "rich"? According to Social Security wage data, only 7% of wage earners in the U.S. make $100,000 a year or more. The median wage is $28,000 a year. Members of Congress make $174,000 a year (when the cap for Social Security taxes is $118,500 a year.)

While $100,000 might not be "rich", it's a helluva lot more than most other people make. So should we care if they are paying alimony or child support to an ex-spouse — just like poor people sometimes do? They could always take a lower paying job. And maybe they should have had a prenup.

https://www.ssa.gov/cgi-bin/netcomp.cgi?year=2013

========= In other News =========

The Center for Public Integrity: Some Medicare Advantage plans overcharged the government by billions of dollars and got away with it

http://www.publicintegrity.org/2015/12/18/19065/some-medicare-advantage-plans-overcharged-government-billions-dollars-and-got-away

Center for Economic Policy and Research (December 27,2015 by Dean Baker) Hold the Celebration on Record Low Unemployment Insurance Claims

ReplyDeleteThe NYT headlined an article on the drop in unemployment insurance claims, "Jobless claims near 42-year low as labor market tightens." While it would be good news if fewer people were filing for unemployment insurance because they were not losing their jobs, this is only part of the story behind the drop in claims. Due to tighter restrictions on unemployment insurance, a much smaller share of the unemployed are eligible for benefits than in prior decades.

For example, in the most recent month, just under 2.2 million people were collecting benefits out of 7.9 million unemployed, which means that 29.1 percent of the unemployed were collected benefits. If we go back to November of 1973 (42 years ago), 1.7 million people were getting benefits out of unemployed population of 4.3 million, for a ratio of 39.5 percent.

Part of the drop in claims in recent years is due to the improvement in the labor market, but part of the decline is due to fewer people being eligible. One can debate whether the tighter restrictions are desirable, but this is clearly a separate issue from a tightening of the labor market.

http://cepr.net/blogs/beat-the-press/hold-the-celebration-on-record-low-unemployment-insurance-claims

Over the past 8 years, the median annual household rose $32 a year.

ReplyDeleteThe median annual household income in November 2015 was $56,746 -- which is 1.1 percent lower than January 2000.

The median annual household income in December 2007 was $56,714 -- when the Great Recession began.

http://www.sentierresearch.com/reports/Sentier_Household_Income_Trends_Report_November2015_12_29_15.pdf