Jobs Created

Keep this in mind when reading this post. From the Bureau of Labor Statistics JOLTS report on January 12, 2016: "Over the 12 months ending in November 2015, hires totaled 61.2 million and separations totaled 58.6 million, yielding a net employment gain of 2.6 million. These totals include workers who may have been hired and separated more than once during the year."

Per the Bureau of Labor Statistics:

In 2010 the US created 1.0 million domestic nonfarm jobs

In 2011 the US created 2.0 million domestic nonfarm jobs

In 2012 the US created 2.2 million domestic nonfarm jobs

In 2013 the US created 2.3 million domestic nonfarm jobs

In 2014 the US created 3.1 million domestic nonfarm jobs

In 2015 the US created 2.6 million domestic nonfarm jobs

Since the onset of the Great Recession to the present (from December 2007 to December 2015), excluding the 8.7 million jobs lost during the economic downturn, we had a NET GAIN of 4.7 million jobs. We broke even in February 2014. Via the St. Louis Federal Reserve:

The Unemployed

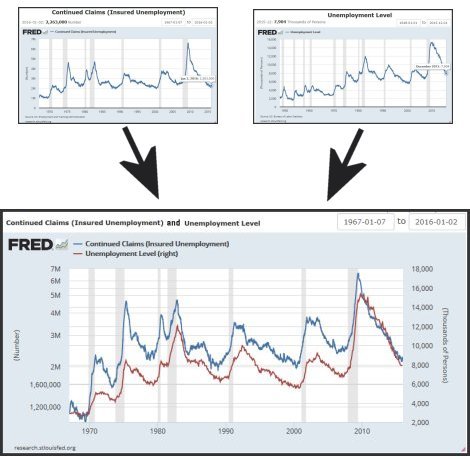

Below shows the number of people counted as "unemployed" (This doesn't include those who dropped out of the labor force; or were never a part of the labor force.) Via the St. Louis Federal Reserve:

Below shows the number of unemployed people receiving unemployment benefits.

Via the St.

Louis Federal Reserve:

If you combine the two charts above showing the number of people unemployed and

the number of people receiving unemployment benefits, you can see they pretty

much trend the same, showing about 1/3 of the jobless have usually been eligible

and receiveed unemployment benefits out of all who those who lost jobs through

no fault of their own (due to off, etc.)

The latest example: As of January 2016 there were 2,263,000 continuing unemployment claims, while 7,904,000 are counted as "unemployed" — which means, only 28.6% (not even a third) of all those counted as "unemployed" are collecting jobless benefits.

Usually to qualify for these benefits, one only has to work one continuous year, be willing and able to work, and were laid off through no fault of their own — meaning, they can't quit their job or get fired for "willful misconduct". The numbers of weeks is determined by each State, and States vary considerably in how they apply these general criteria. (There is a lot of good information here on the subject.)

So, does this mean that two thirds of those who have ever lost a job must either be a temporary worker (working at one or more places for less than a year) or are very bad employees and always getting fired? Because on average, only 1/3 of the jobless ever receive unemployment benefits after they lose their job.

* Remember this? From the Bureau of Labor Statistics JOLTS report on January 12, 2016: "Over the 12 months ending in November 2015, hires totaled 61.2 million and separations totaled 58.6 million, yielding a net employment gain of 2.6 million. These totals include workers who may have been hired and separated more than once during the year."

Whenever a boss wants to fire someone, whether to cut payroll or save costs in vacation pay, they will always try to fire someone for "willful misconduct" so that the ex-employee won't be eligible for unemployment benefits, sometimes forcing the newly jobless worker to appeal many times to the State, all while they are struggling to pay rent and buy food.

The number of people who are counted as "unemployed" doesn't include those "not in the labor force" — because being counted as "unemployed" means someone is still looking for work (a requirement for receiving unemployment benefits); and if someone is still looking for work (even though they are unemployed), they're still counted as part of the labor force.

Not in the Labor Force

This includes those who dropped out of the labor force or were never a part of the labor force (but not those counted as "unemployed"). The number of people not in the labor force went from 79,238,000 in December 2007 (when the Great Recession officially began) to 94,103,000 in December 2015 — for an increase of 14,865,000 over the past 9 years (for an average of 1,651,667 a year) via the St. Louis Federal Reserve:

Of the additional 14,865,000 people who are not in the labor force over the past 9 years, many have retired or went an Social Security disability — even though some people can work and receive reduced benefits. Per Social Security:

As of December 2007 there were 38,626,453 retired and disabled workers on

Social Security disability.

As of December 2015 there were 48,998,491 retired and disabled workers on Social

Security disability.

That means that over the past 9 years we had a net gain of 10,372,038 retired

and disabled workers on Social Security disability.

-14,865,000 additional people who are not in the labor force

over the past 9 years.

-10,372,038 additional people who retired or went on disability over the past 9

years.

= 4,492,962 (The difference) According to the Bureau of Labor Statistics, of

those not

in the labor force, there are 5,886,000 who want

a job now.

Between those that are "officially" counted as unemployed and those who are not in the labor (but want a job), they appear to be mostly prime-age Americans between the ages of 25 (those who would have graduated from college already) and 54 (those who most likely would not have gone on disability or retired already).

Private Unemployment Insurance

(From the Washington Post newsletter): In Tuesday's State of the Union address President Barack Obama called for a wage insurance system so that laid-off workers who took a pay cut in their new jobs could still pay their bills. It may take some time for a federal or state wage insurance program to materialize, but SterlingRisk, a private insurance broker, already sells wage insurance underwritten by the Great American Insurance Company. The policy ("IncomeAssure") guarantees employees up to 50 percent of their lost wages for 26 weeks. Assuming you're eligible for unemployment insurance, SterlingRisk pays the difference between 50 percent of your lost wages and your state's maximum unemployment benefit. Most state unemployment insurance programs already replace about half of workers' previous wages for about 26 weeks, but there are monetary ceilings. In 2014, for example, Mississippi offered a maximum benefit of $235 a week while Massachusetts offered $678 a week. "The problem is many of the people who are getting laid off are getting laid off from these higher paying full-time jobs," SterlingRisk chairman and CEO David Sterling to-unemployment-insurance IncomeAssure has gained traction since its launch four years ago, Sterling said, with "well over 1,000 customers at this point." Policy units grew by 40 percent in 2015 alone, he said, with an average customer salary between $80,000 and $125,000 a year. The top four industries in which IncomeAssure customers work, he said, are finance; professional and business services; education and health services; and information services.

Those who are still employed

Directly below are the approximate quintiles for the 155 million wage earners that we currently have in the U.S. work force, and what they earn according to Social Security wage data:

37,025,230 wage earners make between $5,000 and $10,000 a year (the very bottom quintile).

23,796,712 wage earners make between $10,000 and $20,000 a year.

30,337,461 wage earners make between $20,000 and $35,000 a year (the middle quintile).

32,465,974 wage earners make between $35,000 and $60,000 a year.

32,146,964 wage earners make $60,000 or more a year (the very top quintile).

Those making $1 million year in income (regardless of the source, i.e. capital gains, etc.) would be nearer to the top 0.01%

Whereas, using statistics from the Social Security website — which uses wages reported on W-4 forms rather than using "adjusted gross income" from the IRS (because that also includes income from other sources, such as capital gains) those earning $250,000 a year in regular wages and salaries would be in the top 1% of all "wage" earners. (And BTW, capital gains are taxed at a lower rate than regular wages — and they aren't taxed for Social Security either.)

-155,772,341 total wage earners

-154,084,457 earn LESS than $250,000 a year in wages

= -1,687,884 earn MORE than $250,000 a year in

wages

Senator Bernie Sanders was recently asked in a live appearance on Fusion for the 2016 Brown & Black Democratic Presidential Forum: "How much do you have to earn to be rich?" It took Sanders only a few seconds to answer the question: "I would say that people who make $250,000 a year are doing pretty well." (Hillary Clinton thinks $250,000 a year is "middle-class".)

Using statistics from the IRS website, Politifact found in 2012 that 137,988,219 tax returns out of 140,494,127 — or 98.2 percent — reported adjusted gross incomes of less than $250,000 a year in 2009. (NOTE: 140.5 million tax returns to the IRS in 2012 vs. 155.8 million wage earners paying payroll taxes in 2013)

Healthcare

Hillary Clinton sees a universal healthcare plan and asks, "Why?"

Bernie Sanders sees a universal healthcare plan and asks, "Why not?"

Bernie proposes we expand Medicare (currently for retirees and the disabled) and make it Medicare for All — to include all Americans. He hasn’t released a full plan yet, but he points to previous legislation he’s introduced, namely a 2013 bill for a single-payer Medicare-for-all system, as his general game plan. To pay for it, Sanders would impose broad-based taxes: a 6.7 percent payroll tax on employers and a 2.2 percent tax on individual incomes under $200,000 (or joint incomes under $250,000) with progressively higher rates for higher-income earners as described in his 2013 bill. Sanders’ campaign says his Medicare-for-all plan would save the average American family $3,855 to $5,173 in annual health care costs because co-payments, deductibles and insurance premiums would be eliminated with the slight increase in the Medicare payroll tax. Bernie's campaign plans on releasing a more detailed plan very soon (This is part of the Clinton campaign's attack on him — most likely because, she hasn't been doing as well in recent polls.

The Latest Polls

Nate Silver successfully called the outcomes in 49 of the 50 states in the 2008 U.S. Presidential election, and correctly predicted the winner of all 50 states and the District of Columbia in the 2012 U.S. Presidential election.

Nate Silver, as the founder and editor in chief of FiveThirtyEight, has an interesting take on the 2016 Democratic primary. He uses two models to forecast the outcome of the early primary elections: a polls-only model which only considers polls — and a polls-plus model, which not only considers polls, but also factors in a candidate's establishment endorsements. For Iowa, he writes:

Because public opinion can shift rapidly in the primaries, our models put a lot of emphasis on the most recent polls. That’s good news for Sanders, who has been neck and neck with Clinton in Iowa polls published this month after trailing her for most of last year. In fact, the race is nearly a tossup: He now has a 45 percent chance of winning Iowa according to polls-only, although the polls-plus model, noting Clinton’s dominance in endorsements, is more skeptical of Sanders, giving him a 27 percent chance instead.

For New Hampshire Mister Silver writes:

Sanders is a 73 percent favorite according to polls-only, while polls-plus — noting Clinton’s advantage in endorsements and that she’s favored in Iowa — gives Clinton the slightest edge, with a 53 percent chance to Sanders’s 47 percent. Essentially, she’d be following the path that Al Gore took over Bill Bradley in 2000, when an Iowa victory propelled him to a narrow victory in the Granite State. But the polls-plus model is designed to lower the effect of the endorsements variable to zero by election day in each state. So if Clinton keeps falling in New Hampshire and Iowa polls instead of rising, the establishment may not be able to bail her out, and she’ll have to contemplate the possibility of being swept in both states.

As an aside: Why is Martin O’Malley still hanging on? If he dropped out, would his 2.4% of supporters go to Hillary Clinton or Bernie Sanders?

The Stock Market

A few days ago (before the crash this morning) the Dow Jones was already down to where it was two years ago. As of this post today, the DOW is down another -456.95 points just today, to 15,922 — Holy bat crap Batman! An economic slowdown in China and low gas prices is the explanation being given (again.)

QUOTE OF THE DAY: (From Twitter) "Donald Trump has Muslim friends, Rick Santorum has gay friends, Ted Cruz has imaginary friends."

UPDATE (JANUARY 15, 2016)

ReplyDeleteThe Atlantic:

The gulf between the two Democrats on taxes is perhaps most evident in the debate over paid family leave. Sanders supports the FAMILY Act, which would require employees and employers to each contribute just 0.2 percent of wages, an average of roughly $2 per person, per week. Only wages up to $113,700 would be taxed, meaning the maximum contribution possible—even for the highest earners—would be $227.40 per year.

Clinton, on the other hand, would rely on increased taxes on only the wealthiest Americans to fund paid leave. According to her campaign website, “American families need paid leave, and to get there, Hillary will ask the wealthiest Americans to pay their fair share. She’ll ensure that the plan is fully paid for by a combination of tax reforms impacting the most fortunate.” Clinton has pledged not to raise taxes on middle-class families, which she defines as those making $250,000 or less annually.

Clinton’s campaign promise to not raise taxes on those earning less than $250,000, particularly in the context of paid family and medical leave, ignores the fact that the social, economic, familial, and health benefits of the program—supported by Sanders and so many others—would exponentially outweigh the very modest tax it calls for.

http://www.theatlantic.com/business/archive/2016/01/the-great-clinton-sanders-tax-divide/423318/

The Real Ttate of the Union: Economy (by Dean Baker) January 12, 2016

ReplyDelete"Many Americans are not happy, and with good reason. First, if the economy had followed the path projected in 2010, we would have seen the unemployment rate fall back to 5.0 percent in 2015... However, there is a big difference between the CBO projections on employment and what we have seen over the last six years. CBO expected that the people who dropped out of the labor force in the downturn would soon return to the labor force; it projected in 2010 that total employment in 2015 would be more than 6 million higher it actually was ... The CBO projected that the wage share of GDP would bounce back after its falloff in the recession, reaching 45.4 percent of GDP in 2015. Instead, profits continued to grow at the expense of wages...If GDP had grown as the CBO projected and the wage share had followed the predicted course, then total wages in the economy would be almost 12 percent higher today ... or $6,000 per worker..."

http://america.aljazeera.com/opinions/2016/1/the-real-state-of-the-union-economy.html

On January 15, 2016 at 1;25 p.m. PT on MSNBC --- I just heard a pundit say (while fact-checking Donald Trump from the GOP debate last night) that the reason why the labor participation rate is so low is because of the massive number of baby boomers retiring.

ReplyDeleteThat's total B.S. because the labor force participation rate has been in decline since 2000 and the first boomer didn't retire until 2008. But yet, most economists says it because of the boomers, even though they have a higher LFPR than prime-age workers, because they are working longer.

Millennials now out-number the baby boomers, so expect them to be the next scape goat.

Economist Joe Stiglitz warned back in 2010 that the world risked sliding into a "Great Malaise." Recently he followed up on that grim prediction, saying, "We didn't do what was needed, and we have ended up precisely where I feared we would."

ReplyDeleteThe problems we face now, Stiglitz points out, include a deficiency of aggregate demand, brought on by a combination of growing inequality and a mindless wave of fiscal austerity. He says the only cure is an increase in aggregate demand, far-reaching redistribution of income and deep reform of our financial system. The obstacles to this cure, he writes, are not rooted in economics, but in politics and ideology.

Indeed. Joe Stiglitz is right ... I was wrong.

Western Europe and Japan are in even worse shape than the U.S. is. And today, the main engine of what world economic growth we have seen over the past seven years -- China -- is more than sputtering. The Chinese stock market this week is telling us that China's economy is possibly stalling-out entirely as far as growth is concerned.

Unless something big and constructive in the way of global economic policy is done soon, we will have to change Joe Stiglitz's first name to "Cassandra" -- the Trojan prophet-princess who was always wise and always correct, yet cursed by the god Apollo to be always ignored.

Future economic historians may not call the period that began in 2007 the "Greatest Depression." But as of now, it is highly and increasingly probable that they will call it the "Longest Depression."

Regarding the share of prime-age adults [ages 25 to 54] who had jobs: We have climbed back less than halfway to where we were in 2007 and less than a third of the way back to where we were in the full-employment year of 2000 [In April of that you was the all-time high for the labor force partcipation rate. It also happens to be the same year that Bill Clinton gave permanent normal trade relations with China.]

=

What we need now is 1) debt relief to unwind the overhang and 2) much tighter financial regulation to prevent the growth of new fragilities. And if those prove inconsistent with full recovery, then we need massive government spending on infrastructure and other investments financed by money printing until full employment is reattained.

The second task will be one of political organization. For until politicians, finance ministry technocrats and central bankers feel under pressure to respond to and in fact internalize the diagnoses of Stiglitz, Eichengreen, Wolf and others, our problems will remain, as Stiglitz puts it, "not rooted in economics, but in politics and ideology."

And it is only after those ideological and political blockages have been removed that the tasks of economic policy -- and then of shifting policy to deal with the new problems that arise as consequences of fixing our current economic policies -- can be seriously begun.

http://www.huffingtonpost.com/brad-delong/global-economic-depression_b_8924596.html

Hillary Clinton has gone all the way around the bend, and has decided to ramp up unnecessary fearmongering, dispatching her daughter to New Hampshire to darkly warn that Bernie Sanders is gonna take everyone’s health care away. Of course, this is not true. Under a single-payer system, everybody gets health care. That's the entire point, as Hillary Clinton well knows. Chelsea Clinton knows it too. Chelsea Clinton has a masters degree in public health from Columbia. She knows exactly how what she’s saying obfuscates the issue.

ReplyDeletehttp://www.huffingtonpost.com/entry/hillary-clinton-is-botching-this_569808a9e4b0778f46f8b31b

BIG UPDATES (January 19, 2016)

ReplyDeletePresident Obama delivered more specifics in his weekly radio address . Under the plan, workers laid off from a job they held at least three years would be eligible for state-based wage insurance if their new job paid less than the old one and no more than $50,000. The insurance payment would replace half the lost wages, the White House said, up to $10,000 over two years. The president also proposed requiring states to provide no fewer than 26 weeks' unemployment insurance benefits; extending those 26 weeks to a federally-funded 52 in states "experiencing rapid job losses or high unemployment" (according to a White House fact sheet ); and providing grants to help create work-sharing programs "that help employers reduce hours instead of laying off workers while providing partial unemployment benefits to workers whose hours are cut" (ditto). http://1.usa.gov/1n6Zsbh

https://www.whitehouse.gov/the-press-office/2016/01/16/fact-sheet-improving-economic-security-strengthening-and-modernizing

New state and city minimum wage laws have drawn scrutiny from the Labor Department because they might require employers to reimburse tipped workers above a federal ceiling, the Portland Press Herald reports. In Maine, for example, Portland set its minimum wage at $10.10, but the tipped minimum was untouched at $3.75. Employers might therefore have to compensate tipped workers $6.35 to make up the difference. But the ceiling for such a credit is $5.12 under the Federal Labor Standards Act. The scrutiny has led Republican Gov. Paul LePage to expect a Labor Department lawsuit, but legal experts quizzed by the Press-Herald feel less certain about that.

http://www.pressherald.com/2016/01/16/u-s-labor-department-reviewing-portlands-minimum-wage-hike/