...that, according to her recent Tweet. (More on that later below.)

50% of the federal budget is spent on Social Security and healthcare. Shouldn't 50% of the next Democratic debate be spent on these two issues? Their next debate will be on February 11th and will be moderate by PBS's Gwen Ifill and Judy Woodruff, a disability advocate. My question for Judy Woodruff for BOTH candidates would be:

|

(Actually, Bernie Sanders has already done this, as I note further below. But I don't want the question to appear as though it was deliberately targeted at Hillary Clinton, which it is of course, because she's been so obscure about her own plan.)

Although it goes without saying (but I will say it anyway), it's not necessary for the Republicans to spend much time on the issues of Social Security and healthcare in their debates. It's already well-known that they all want to cut taxes, reduce benefits, privatize everything and raise the age for retirement benefits — even though it's the rich who are living longer (and the rich don't need Social Security or Medicare).

* EDITOR'S SIDE NOTE: About another 20% of the federal budget is spent on defense, so maybe 20% of the next debate should be spent on this subject as well. Both the Democrats and the Republicans like this type spending, because it creates lots of jobs in all 50 States — and far too many overseas — which is proof that the government does indeed create jobs, many jobs, and not just those in the private sector who create jobs for the benefit of the average consumer (as the GOP wants us to believe). The government creates more jobs and better paying jobs than Wal-Mart, the largest job creator in the private sector — whose employees rely on government benefits like food stamps because their wages are so low. The economist Dean Baker points out that it's been stagnant wages that has mostly contributed to the shortfall in Social Security funding. And there is far much more waste, fraud and abuse in defense spending than there is in Social Security over-payments and fraud. But the topic of this particular post is about raising the Social Security cap and taxing capital gains to expand Social Security, not cutting benefits.

The Center on Budget and Policy Priorities reported on March 11, 2015 that in 2014, 24 percent of the budget — or $851 billion — was paid to Social Security. Four health insurance programs — Medicare, Medicaid, the Children’s Health Insurance Program (CHIP), and Affordable Care Act marketplace subsidies — together accounted for 24 percent of the budget in 2014 — or $836 billion.

Last month on January 25, 2016 UPI reported that a CBO report says that for the first time, health spending surpassed Social Security in 2015. Money spent on health programs like Medicare, Medicaid, the Children's Health Insurance Program and ACA subsidies amounted to $936 billion last year — and Social Security received $882 billion. The figures were included on page nine of the office's budget outlook for the next decade. "That increase is largely attributable to legislation enacted since August 2015 — in particular, the retroactive extension of a number of provisions that reduce corporate and individual income taxes."

2015: $936 billion for healthcare and $882 billion for Social Security

2014: $836 billion for healthcare and $851 billion for Social Security

------ $100 billion MORE

---------------$31 billion MORE

One thing is obvious: either taxes must be increased, or cuts must be made. We can either raise taxes on the top 5% and the ultra-rich, or else we must cut government benefits for the middle-class, the working-poor and the ultra-poor (Yes, Hillary, that includes women too.) So one or the other must happen — raise taxes or cut benefits. We can't have it both ways.

Bernie Sanders wants to raise the cap for Social Security to expand Social Security for the bottom 95% of wage earners, while also creating universal healthcare with a Medicare for All plan, by both raising the $118,000 cap for Social Security taxation to $250,000 (those in the top 5%) — and repealing the special tax break for capital gains by taxing the capital gains income of the very rich at the same rate as regular wages.

Hillary, on the other hand, claims Bernie's plans aren't "pragmatic", and that she's the only "progressive" that can get things done. (It she were president it 1962, we would have never went to the moon). Hillary will say anything it takes to get herself elected by making promises she can't keep — like not raising taxes AND not cutting Social Security. How "pragmatic" is that? Until now, her whole campaign has been about politically expediency.

But now, just like Senators Bernie Sanders and Elizabeth Warren, Clinton has just Tweeted that she too will also expand Social Security. Which means, she'll have to break her pledge of not raising taxes on those that she defines as "middle-class".

The link goes to Hillary Clinton's website, where it says: "Social Security must continue to guarantee dignity in retirement for future generations. Hillary understands that there is no way to accomplish that goal without asking the highest-income Americans to pay more, including options to tax some of their income above the current Social Security cap, and taxing some of their income not currently taken into account by the Social Security system."

This is important to note, because the differentiation in her recent Tweet is much more profound than she previously stated. She doesn't just generally say she'll "defend" Social Security; but now specifically claims she'll "expand" Social Security. Just like with the TPP trade deal, the Keystone pipeline, and on many other issues, Bernie has been forcing Hillary more to the left of her previously held "moderate" stands on the issues (because she knows how popular Bernie's stand on the issues have been.)

TIME (February 5, 2016) A day after a hard-fought debate in New Hampshire, a more combative Bernie Sanders called on Hillary Clinton on Friday afternoon to pledge to expand Social Security benefits, challenging his opponent on a top issue for progressives. Sanders has made expanding Social Security payouts to seniors a central part of his campaign. “I ask Secretary Hillary Clinton to join me in making it very clear that, number one, she will not support any cuts to Social Security,” Sanders said at a town hall in Exeter, N.H. on a snowy Friday. “And number two, that she will join me in saying it is imperative that we increase and expand benefits for senior citizens and disabled veterans on Social Security,” Sanders continued. Clinton has pledged to expand Social Security for widows and has also said she is open to increasing taxes on the wealthy to put more funding into the program, but she has not committed to expanding the program as Sanders has, something grassroots progressive groups have called for. When Sanders tweeted later on Friday and repeated his pledge asking her not to cut Social Security, the former secretary of state shot back, saying “I’ll expand it” and adding “enough false innuendos.”

But her new talking point of always accusing Senator Bernie Sanders of "false innuendos” is just plain false. It was Hillary herself who pledged not to raises taxes on the "middle-class" while accusing Bernie Sanders of doing just that, while she herself has also now proposed the same thing, by raising taxes on the so-called "middle-class".

Mother Jones: Hillary Clinton's Strange Definition of "Middle Class" (November 20, 2015) "Clinton has proposed a bold, aggressive agenda," campaign press secretary Brian Fallon said in a statement this week, "but when it comes to paying for it, she will make sure the wealthiest Americans finally start paying their fair share, not force the middle class to pay even more than they already do." ... There's a problem with Clinton's line of attack [against Bernie Sanders]: She is promising to exempt a lot of indisputably rich people from paying more in taxes. Clinton pledged last week that, should she become president, she wouldn't allow taxes to be raised on households earning less than $250,000 per year ... The Democratic candidate promises to not raise taxes on people who are well within the top 5 percent.

New York Times: $250,000 a Year Is Not Middle Class (December 28, 2015) Hillary Clinton has vowed not to raise taxes on the middle class. The most recent Census Bureau data showed that "median household income" is $53,657. Those families who make $250,000 a year, on the other hand, belong to an elite group: Americans who earn enough to be in the highest 5 percent of the income distribution. Bernie Sanders also wants to help the middle class, but he wants to do it in a way that could mean raising its taxes, even if he promises that most of an increased burden will fall on the wealthy. This has made him a target of the Clinton camp, which is telling voters that Mrs. Clinton is the only candidate pledging to shield the middle class. Mr. Sanders has avoided any pledge against middle-class tax increases. The paid family leave program both support is designed as social insurance much like Social Security, funded by a 0.2 percent payroll tax increase. Yet Mrs. Clinton’s pledge rules out supporting such a proposal. While she has frequently talked about paid family leave, she says her plan will call on only the wealthiest to pay for it.

The Social Security cap is currently set at $118,500 — meaning every dollar of regular wages/salaries over this amount is totally exempt from Social Security taxes. And all capital gains income is also exempt, meaning, billions of dollars a year in income from stock trades — and the sale of beachfront mansions, precious stones, gold bars, priceless art (SWAG investments, etc.) — all escape any taxation at all for Social Security.

Huffington Post (February 6, 2015) Hillary Clinton promised that she would not cut Social Security benefits, winning praise from progressive groups that had pressured her to take such a stance -- but drawing questions from Sen. Bernie Sanders, who challenged her commitment to the issue. "I won't cut Social Security," Clinton wrote in an initialed tweet that included a link to her campaign website’s Social Security page. "As always, I'll defend it, & I'll expand it. Enough false innuendos." The post was a response to something Sanders had tweeted earlier in the day, when he urged Clinton to "join me in saying loudly and clearly that we will never cut Social Security."

Remember: At Hillary Clinton's website it says: "Social Security must continue to guarantee dignity in retirement for future generations. Hillary understands that there is no way to accomplish that goal without asking the highest-income Americans to pay more, including options to tax some of their income above the current Social Security cap, and taxing some of their income not currently taken into account by the Social Security system."

Which brings us back to my question for PBS's Judy Woodruff: not just consider options — or to just understand — or tax some income, but to actively promote new legislation to raise the cap for Social Security taxes (and by how much), and specifically say "tax capital gains for Social Security".

If she agrees, then that means that Hillary Clinton is willing to raise taxes on income earned from regular wages/salaries over $118,500 a year by raising the $118,500 cap (but she hasn't yet mentioned a new cap), and also by taxing capital gains for Social Security ("Income not currently taken into account").

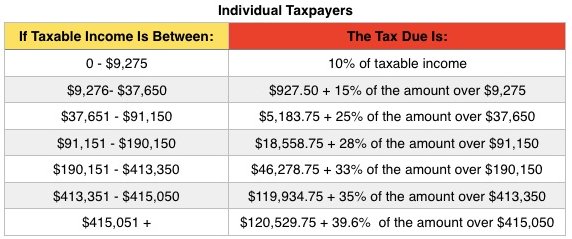

Bernie Sanders wants the cap set at $250,000 for regular wages/salaries — and he has also advocated for taxing capital gains as regular income (see the current tax brackets below), because capital gains is taxed at a much lower rate than real "middle-class" wages. The Social Security Administration reports that 50% of all wage earners make $28,850 a year or LESS. People making millions of a dollars a year in capital gains income pays a tax rate of only 23.8% (before their tax attorneys whittle down even lower). That's why it's much lower than the tax rate of Warren Buffett's secretary.

So Hillary Clinton's fake pledge not to tax the middle-class (by her definition, those making up to $250,000 a year) is not

at all possible. It's simple math. She knows this, but yet she still attacks Bernie and

accuses him of "false innuendos" — when in reality, it is she (and

now Bill) who has been making "false innuendos". Which just goes to prove, no matter how much foreign policy experience she has, Hillary Clinton must raise taxes on the

so-called "middle-class" to fulfill her tax pledge, or her promises were only made

for political expediency.

My Related Posts:

- Tuesday, November 17, 2015: Hillary Clinton thinks $250,000 a year is "Middle-Class"

- Thursday, June 4, 2015: Bernie Sanders vs. Hillary Clinton on Social Security

- Friday, November 6, 2015: Bernie Sanders vs. Hillary Clinton on Social Security

- Saturday, January 9, 2016: Bernie Sanders vs. Hillary Clinton on Paid Family Leave

- Monday, December 21, 2015: Bernie vs Hillary in defining the Middle-Class

For my other posts on this subject, Google "Bud Meyers Social Security" or "Bud Meyers disability"

Next Debate: The 6th Democratic debate will be held on the campus of the University of Wisconsin-Milwaukee on Thursday, February 11th. The DNC-sanctioned debate will be held in the Helen Bader Concert Hall in the Helene Zelazo Center for Performing Arts. NewsHour co-anchors and managing editors Gwen Ifill and Judy Woodruff will moderate the PBS NewsHour Democratic Primary Debate, to be broadcast nationwide by PBS and WETA Washington, D.C. — In addition to the national live broadcast on PBS, the debate — produced in cooperation with Milwaukee Public Television and WUWM 89.7 FM — will be streamed online at pbs.org/newshour. The debate will begin at 8:00 p.m.

UPDATE from the L.A. Times 2 hours ago (regarding Obama's new budget proposal):

ReplyDeleteIn case it wasn't clear enough, here's what House Budget Committee Chairman Tom Price (R-Ga.) said about the decision not to hold a hearing:

"Nothing in the president's prior budgets — none of which have ever balanced — has shown that the Obama Administration has any real interest in actually solving our fiscal challenges or saving critical programs like Medicare and Social Security from insolvency. Rather than spend time on a proposal that, if anything like this Administration's previous budgets, will double down on the same failed policies that have led to the worst economic recovery in modern times, Congress should continue our work on building a budget that balances and that will foster a healthy economy."

...If you exclude the Social Security Trust Fund, Congress has been running deficits since the Eisenhower administration. While Price proposed a budget last year that laid out a path to balance, he didn't take the steps he could have taken to push Congress down that road — for example, by calling for a budget "reconciliation" bill that would have limited spending on such popular but costly programs as Medicare.

... The only reconciliation bill the latest Congress has considered was a purely political gesture that would have repealed major tenets of Obamacare and blocked federal funding for Planned Parenthood. That required no display of political courage on the GOP's part, unlike a bill to turn Medicare into a voucher program — an idea that's integral to the House GOP's previous multiyear plans to balance the budget. Oh, and by the way, Price's budget last year would have made it harder to save the Social Security Disability Income trust fund from insolvency. That's not to say Obama's budget proposals have been more fiscally responsible. The president has failed year after year to lay out a path to budgetary sustainability or a solution to the long-term problems posed by Medicare and other federal health programs.

... A deal struck last year between congressional leaders and the White House sets the spending levels for fiscal 2017, as well as deciding how the pot will be divided between defense and non-defense programs.

http://www.latimes.com/opinion/opinion-la/la-ol-obama-budget-no-hearing-congress-20160205-story.html