| Current Tax brackets | The new House Tax Plan | The new Senate Tax Plan | |||

| Income | Tax Rate (single) | Income | Tax Rate (Single) | Income | Tax Rate (single) |

| $0 to $9,325 | 10% | 0 - $12,000 | 0 | $0 to $9,525 | 10% |

| $9,325 to $37,950 | 15% | $12,000 to $45,000 | 12% | $9,525 to $38,700 | 12% |

| $37,950 to $91,900 | 25% | $45,000 to $200,000 | 25% | $38,700 to $60,000 | 22.5% |

| $91,900 to $191,650 | 28% | $200,000 to $500,000 | 35% | $60,000 to $170,000 | 25% |

| $191,650 to $416,700 | 33% | Over $500,000 | 39.6% | $170,000 to $200,000 | 32.5% |

| $416,700 to $418,400 | 35% | - | - | $200,000 to $500,000 | 35% |

| Over $418,400 | 39.6% | - | - | Over $500,000 | 38.5% |

End to the Update to the Update . . .

UPDATE: Trump, the GOP, the conservative media and Fox News have all been saying the Republicans want to cut taxes for the middle-class, but not one single Republican (or Democrat) will publicly state what income level they believe represents the "middle-class". The "median" annual income in 2016 was $30,557.71 a year per wage data at Social Security. For the sake of argument, this post considers a SINGLE person earning between $45,000 and $91,900 a year (before taxes) is making a solid "middle-class" wage.

The chart below compares the 2017 tax brackets and tax rates to the GOP's newest tax plan (and to Trump's original tax proposal.)

|

* Current tax

deductions for SINGLE filers: $10,400 ($6,350 standard deduction +

$4,050 personal exemption) |

|||||

| Tax brackets currently for 2017 | The GOP's newest Tax Plan | Tax brackets under Trump's original tax plan | |||

| Income | Tax Rate (single) | Income | Tax Rate (Single) | Income | Tax Rate (single) |

| $0 to $9,325 | 10% | 0 - $12,000 | 0 | $0 to $25,000 | 0% |

| $9,325 to $37,950 | 15% | $12,000 to $45,000 | 12% | $25,001 to $50,000 | 10% |

| $37,950 to $91,900 | 25% | $45,000 to $200,000 | 25% | $50,001 to $150,000 | 20% |

| $91,900 to $191,650 | 28% | $200,000 to $500,000 | 35% | $151,000 and up | 25% |

| $191,650 to $416,700 | 33% | Over $500,000 | 39.6% | - | - |

| $416,700 to $418,400 | 35% | - | - | - | - |

| Over $418,400 | 39.6% | - | - | - | - |

Under the GOP's newest tax proposal:

Those earning $37,950 or LESS will have a lower tax

rate (The working-class and poor.)

Those earning between $45,000 and $91,900 will have the

same tax rate (The middle-class).

Those earning $91,900 to $500,000 will have a lower tax

rate (Congress, doctors, lawyers, etc.).

Those earning $500,000 or MORE will have the same tax rate

(Big CEOs, hedge fund managers, etc.).

* The newest wage data (as of this post) from Social Security shows 50% of wage earners had a net compensation of LESS-than or EQUAL-to the MEDIAN WAGE of $30,558 a year. (Double that for an approximate "median household" income.)

* ORIGINAL POST BELOW THIS LINE

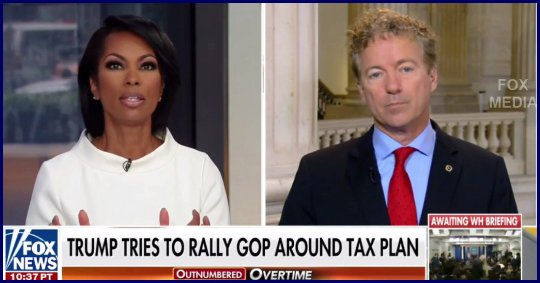

Yesterday Senator Rand Paul told Fox News that a middle income is between $75,000 to $300,000 a year. But new wage data from the Social Security Administration (SSA) contradicts that claim. The SSA reports that 50% of wage earners had a net compensation LESS-than or EQUAL-to the MEDIAN WAGE of $30,558 a year. (So obviously the other 50% of wage earners had net compensation MORE-than or EQUAL-to the MEDIAN WAGE.)

Rand Paul says (video further below) that Trump's new tax plan is going to lower the very top tax rate for hourly wages and salaries from 39% to 35%. First of all, that top rate is currently 39.6% — so the GOP (with the proposed tax plan) will lower the top rate 4.6% for [single] people earning $418,400 or more a year.

|

Tax brackets currently as is for 2017 |

Tax brackets under Trump's tax plan for 2018 | |||||

| Income | Tax Rate (single) | Tax on Capital Gains | Income | Tax Rate (single) | Tax on Capital Gains | |

| $0 to $9,325 | 10% | 0% | $0 to $25,000 | 0% | 0% | |

| $9,325 to $37,950 | 15% | 0% | $25,001 to $50,000 | 10% | 0% | |

| $37,950 to $91,900 | 25% | 15% | $50,001 to $150,000 | 20% | 15% | |

| $91,900 to $191,650 | 28% | 15% | $151,000 and up | 25% | 20% | |

| $191,650 to $416,700 | 33% | 15% | - | - | - | |

| $416,700 to $418,400 | 35% | 15% | - | - | - | |

| Over $418,400 | 39.6% | 20% | - | - | - | |

Rand Paul also said the plan would expand the standard deduction "for those who are poor" (even though EVERYBODY gets a standard deduction) from $6,350 to $12,000 — but the plan will also eliminate the $4,050 personal exemption that everyone currently gets . . . and eliminates deductions for State tax that some people pay on their wages (some people also pay city and county income taxes as well.)

Rand Paul said he was concerned about taxes going up for those "in the middle" who are currently taxed at 25% on annual income ranging from $37,950 to $91,000 a year (FYI: The REAL middle would be the "median wage", which was $30,557 a year for last year in 2016). But Rand Paul may not need to worry about that according to tax brackets in Trump's plan (posted on his website), because people in the 25% bracket are cut down to the 10% and 20% tax brackets.

Rand Paul says he and Trump both agree, that they don't want to raise taxes on the "middle-class" (without saying what tax brackets of annual income they consider to be middle-class).

Rand Paul says people who make between $75,000 a year [which is in the top 15.9%] up to $300,000 a year [which is in the top 0.9%], is what he calls:

"The middle and some upper-middle-class, who aren't extremely wealthy, but are doing pretty well."

Rand Paul worries that if you take always some big deductions [such as mortgage deductions? He didn't specify], and keep the rate at 25%, there's a chance they may pay more in taxes. Rand Paul, as a member of Congress, make s $174,000 a year (not counting a Senate allowance which is worth just as much). So basically, he's worried that HIS taxes might go up under Trump's tax plan.

The Fox News host (in Rand Paul's interview below) either doesn't have a clue as to what she's talking about, or is complicit in duping the American public to make sure the very wealthy ALSO get a huge tax cut.

THIS IS IMPORTANT: Part of the "middle" that Rand Paul refers to (up to $150,000 a year) will get a 5% tax cut (down from 25% to 20%); while some will stay at 25%. But it appears that Rand Paul is mostly worried about people making over $150,000 a year (the top 3.77%) whose tax rates could go down from 28%, 33% or 35% (down from 39.6% under Trump's plan. >>> Going from 39.6% to 25% is a cut of 14.6% - - - but many in the so-called "middle" will only get a cut of 5% (down from 25% to 20%) But most people (without children) in the middle-class will see no change --- the tax rate remains the same at 25%.

* FYI: This post only refers to hourly wages and salaries for labor, not capital gains income from investments.

My related posts on the middle-class wage and two-income households . . .

December 10, 2015: Middle-Class Shrunk MORE than Pew Claims

https://bud-meyers.blogspot.com/2015/12/middle-class-shrunk-more-than-pew-claims.html

November 17, 2015: Hillary Clinton thinks $250,000 a year is

"Middle-Class"

https://bud-meyers.blogspot.com/2015/11/hillary-clinton-thinks-250000-year-is.html

February 7, 2015: Only 20% are Middle-Class, Most Don't Come Close

http://www.economicpopulist.org/content/only-20-are-middle-class-most-dont-come-close-5679

November 10, 2013: Two-Income Households Earning Median Wages...is not enough,

and is not a middle-class income.

https://bud-meyers.blogspot.com/2013/11/two-income-households-earning-median.html

May 2, 2012: Two Income Households, 'Mean' and 'Median' Income Statistics

https://bud-meyers.blogspot.com/2012/05/two-income-households-mean-and-median.html

January 1, 2012: Will 2 Paychecks Be Enough in 2012? Ask Elizabeth Warren

https://bud-meyers.blogspot.com/2012/01/will-2-paychecks-be-enough-in-2012-ask.html

Median and Dual Income Households in 2011

http://www.bud-meyers.com/2011/

My related posts on the middle-class wage and two-income households . . .

ReplyDeleteDecember 10, 2015: Middle-Class Shrunk MORE than Pew Claims

https://bud-meyers.blogspot.com/2015/12/middle-class-shrunk-more-than-pew-claims.html

November 17, 2015: Hillary Clinton thinks $250,000 a year is "Middle-Class"

https://bud-meyers.blogspot.com/2015/11/hillary-clinton-thinks-250000-year-is.html

February 7, 2015: Only 20% are Middle-Class, Most Don't Come Close

http://www.economicpopulist.org/content/only-20-are-middle-class-most-dont-come-close-5679

November 10, 2013: Two-Income Households Earning Median Wages...is not enough, and is not a middle-class income.

https://bud-meyers.blogspot.com/2013/11/two-income-households-earning-median.html

May 2, 2012: Two Income Households, 'Mean' and 'Median' Income Statistics

https://bud-meyers.blogspot.com/2012/05/two-income-households-mean-and-median.html

January 1, 2012: Will 2 Paychecks Be Enough in 2012? Ask Elizabeth Warren

https://bud-meyers.blogspot.com/2012/01/will-2-paychecks-be-enough-in-2012-ask.html

Median and Dual Income Households in 2011

http://www.bud-meyers.com/2011/

NOV 11, 2017 --- MY FULL UPDATE TO THIS POST HERE:

ReplyDeleteGOP's proposed Tax Rates compared to 2017 Tax Rates

https://bud-meyers.blogspot.com/2017/11/gops-proposed-tax-rates-compared-to.html