Unless of course, you're a wealthy investor.

Real gross domestic product (GDP: the value of the goods and services produced by the nation's economy, less the value of the goods and services used in its production) increased at an annual rate of 3.7 percent in the second quarter of 2015.

A former member of the Fed was on Fox News yesterday and had said "increased productivity" and "tax cuts" were very important for "growth" — and that more growth would best resolve the matter of "wealth redistribution" and "income inequality".

But isn't that called "trickle-down economics" — when a rising tide is supposed to lift all boats? And isn't that what we've had for the past 35 years — all while wages have remained stagnant?

Haven't we had any "growth" at all for the past 35 years? Let's look at the stock market and see...

Hmmmmmm. That looks like "growth" to me. Now let's have look at "wealth redistribution" and "income inequality" during that same period of time (when we've had all that "growth")...

Hmmmmmm. Over the past 35 years, did more "growth" resolve the matter of "wealth redistribution" and "income inequality"?

And if not, then does it really matter to most people if the economy grew by 3.7 percent in the second quarter of 2015 — or if it grew at 1% or 5%? Does it really matter if "productivity" went up (or down) if all the increases in growth and profits just mostly goes to wealthy investors, rather than partially (and fairly) redistributed into higher wages for workers?

What if the "job creators" paid NO TAXES AT ALL — (and for that matter, had no regulations imposed on them) — would that be a guarantee that they'd all be paying their workers fair and living wages? Would that eradicate the problem of "income inequality"? Or is more "growth" only good for rich investors, and nothing more — and that more tax breaks would only put more cash in their pockets?

Prominent economist and Nobel Prize winner Joseph Stiglitz (and a Fellow of the progressive Roosevelt Institute), said: “An economy that doesn’t deliver for most of its citizens is a failed economy.” From his new paper:

America has not been doing well in either equality of outcomes or opportunity. We have obtained the dubious distinction of being the country with the highest level of inequality of outcomes, and among the lowest levels of equality of opportunity, compared to other advanced economies ... the American dream today is to a large extent simply a myth. The life prospects of a young American are more dependent on the income and education of his or her parents than in almost any of the other advanced countries. Wages and benefits for American workers grew at the slowest pace in 33 years in the second quarter this year..."

Yesterday at the L.A. Times Stiglitz also wrote:

Despite a headline unemployment rate of 5.3%, the true labor market situation faced by working families in the United States remains dire. Millions remain trapped in disguised unemployment and part-time employment ... The true unemployment rate, including those working part time involuntarily and marginally attached, is more than 10.4% ... Poor labor market conditions are also reflected in wages and incomes. So far this year, wages for production non-supervisory workers, which tracks closely to the median wage, fell by 0.5%. Median household income — a better indicator of how well the economy is doing as seen by the typical American than GDP — at last measure was lower than it was a quarter-century ago ... Quantitative easing was yet another instance of failed trickle-down economics — by giving more to the rich, the Fed hoped that everyone would benefit. But so far, these policies have enriched the few without returning the economy to full employment or broadly shared income growth.

(* David Dayen at the Fiscal Times tells us why conservatives are so desperate to debunk the chart above regarding workers' wages.)

UPDATE:

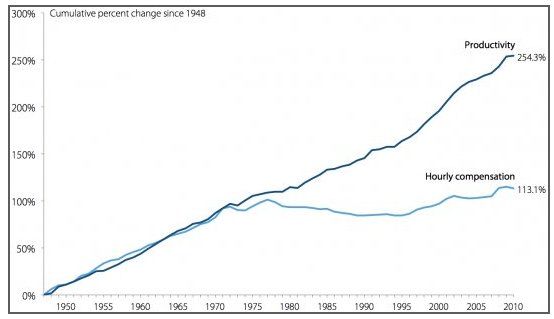

ReplyDeleteThe Divergence Between Productivity and Pay

EPI BRIEFING PAPER (Sept. 2, 2015)

Since the 1970s, wages did not stagnate for the vast majority because growth in productivity, income and wealth creation collapsed.

Productivity still managed to rise substantially in recent decades, but essentially none of this productivity growth flowed into the paychecks of typical American workers.

Pay failed to track productivity primarily due to more wage and salary income accumulating at the very top of the pay scale and the shift in the share of overall national income went to owners of capital and away from the pay of employees.

Income generated in an average hour of work in the U.S. economy has not trickled down to raise hourly pay for typical workers.

Since 1973, hourly compensation of the vast majority of American workers has not risen in line with economy-wide productivity. In fact, hourly compensation has almost stopped rising at all.

If the hourly pay of typical American workers had kept pace with productivity growth since the 1970s, then there would have been no rise in income inequality during that period.

The economic evidence indicates that the rising gap between productivity and pay for the vast majority likely has nothing to do with any stagnation in the typical worker’s individual productivity.

http://s1.epi.org/files/2015/understanding-productivity-pay-divergence-final.pdf

* A former member of the Fed was on Fox News the other day and had said "increased productivity" and "tax cuts" were very important for "growth" — and that more growth would best resolve the matter of "wealth redistribution" and "income inequality".

But isn't that called "trickle-down economics" — when a rising tide is supposed to lift all boats? And isn't that what we've had for the past 35 years — all while wages have remained stagnant?

And didn't we have any "growth" during that time when the DOW went from 950 in Sept. 1980 to over 16,000 in Sept. 2015?

UPDATE: Wage Declines Since the Great Recession

ReplyDeleteNational Employment Law Project (NELP: Sept. 2, 2015)

Occupational Wage Declines Since the Great Recession: Low-Wage Occupations See Largest Real Wage Declines

"Most workers have failed to see improvements in their paychecks. In fact, taking into account cost-of-living increases since the recession officially ended in 2009, wages have actually declined for most U.S. workers. Inflation-adjusted or “real” wages reflect workers’ true purchasing power; as real wages decline, so too does the amount of goods and services workers can buy with those wages. The failure of wages to merely keep pace with the cost of living is not a recent phenomenon. The declines in real wages since the Great Recession continue a decades-long trend of wage stagnation for workers in the United States.

http://www.nelp.org/publication/occupational-wage-declines-since-the-great-recession/

11-page paper:

http://www.nelp.org/content/uploads/Occupational-Wage-Declines-Since-the-Great-Recession.pdf

Economic Populist: Fed Up with Stagnant Wages and Corrupt Politicians

http://www.economicpopulist.org/content/fed-stagnant-wages-and-corrupt-politicians-5799

New York Times EDITORIAL BOARD (September 7, 2015)

ReplyDelete"Flat or falling pay is self-reinforcing because it dampens demand and, by extension, economic growth. In the current recovery, median wages have fallen by 3 percent, after adjusting for inflation, while annual economic growth has peaked at around 2.5 percent ... Why has worker pay withered? The answer, in large part, is that rising productivity has increasingly boosted corporate profits, executive compensation and shareholder returns rather than worker pay. Chief executives, for example, now make about 300 times more than typical workers, compared with 30 times more in 1980 ... In the past year, low-wage workers have successfully fought for minimum wage increases in states and cities. Congressional Democrats have championed legislation to raise the federal minimum wage and to fight wage theft and abusive worker scheduling. The Labor Department is moving ahead with a much needed new rule to update the nation’s overtime-pay laws."

http://www.nytimes.com/2015/09/07/opinion/you-deserve-a-raise-today-interest-rates-dont.html

Economic Policy Institute: The Agenda to Raise America’s Pay (Which Senator Bernie Sanders has been campaigning for.)

http://www.epi.org/pay-agenda/

Economic Policy Institute (September 10, 2015) "Since 2000, the share of income generated by corporations going to workers’ wages declined ... Had the share remained the same over this time, labor compensation today would be high enough to give each U.S. worker a $3,770 raise."

ReplyDeletehttp://www.epi.org/publication/the-decline-in-labors-share-of-corporate-income-since-2000-means-535-billion-less-for-workers/

RELATED POSTS:

Wages decline, productivity soars

http://www.marketplace.org/topics/wealth-poverty/wages-decline-productivity-soars

Making sense of good job growth and stagnant wages

http://www.marketplace.org/topics/economy/making-sense-good-job-growth-and-stagnant-wages

The New York Times’ editorial board cited EPI research on how CEOs now make 300 times more than typical workers.

http://www.nytimes.com/2015/09/07/opinion/you-deserve-a-raise-today-interest-rates-dont.html

Paul Krugman of the New York Times also cited data from EPI’s report on the productivity–pay gap:

http://krugman.blogs.nytimes.com/2015/09/06/productivity-and-pay/