Comment: "Redlining" is defined as refusing a loan or insurance to someone because they live in an area deemed to be a poor financial risk. This was a very common practice 40 years ago. Banks "redlined" minority communities for the purpose of home mortgages because of the disproportion number of defaults on their loans. Black business people and black bankers also relined. Banks imposed restrictions on potential investors before making them real estate loans.

"Reverse redlining" is a variation, where banks target parts of a city with significant minority populations in order to sell them costly sub-prime mortgages, even if they can afford cheaper prime mortgages. Hillary Clinton supported bailing out the banks who participated in this activity — those who committed fraud by selling bogus securities that were bundled mortgages (and auto loans) which were in or near default (known as credit default swaps or "derivatives) which were fraudulently rated "AAA" by Moody's and other credit agencies.

In 1994, Barack Obama was one of the plaintiffs in a class action lawsuit, alleging that Citibank had engaged in practices that discriminated against minorities. The lawsuit forced the bank to ease its lending practices. The Daily Caller reported:

President Barack Obama was a pioneering contributor to the national subprime real estate bubble, and roughly half of the 186 African-American clients in his landmark 1995 mortgage discrimination lawsuit against Citibank have since gone bankrupt or received foreclosure notices ... Obama has pursued the same top-down mortgage lending policies in the White House ... Obama’s lawsuit was one element of a national “anti-redlining” campaign led by Chicago’s progressive groups, who argued that banks unfairly refused to lend money to people living within so-called “redlines” around African-American communities. The campaign was powered by progressives’ moral claim that their expertise could boost home ownership among the United States’ most disadvantaged minority, African-Americans.

Then we had the housing crash when prices began declining in 2006 and lasted almost 9 years. Obama's AG Eric Holder refused to prosecute a single banker, even though the banks were eventually fined billions of dollars for their illegal, unethical and fraudulent activities. Other than Obama, Hillary Clinton has taken more money from the bankers than anyone else — by way of campaign contributions, through fundraisers, in donations to her foundation and in paid speeches.

It was Hillary Clinton's husband who helped deregulate the banks in 1999 that allowed these banks to engage in this criminal activity — so she should be the LAST person to complain of Trump's real estate investment practices. While this post is not to exonerate Trump from his past practices, it was very widespread and very common 40 years ago. Maybe Trump has "evolved" since then, just as Clinton has on a variety of issues, such as her husband's crime bill, private prisons and welfare reform (etc).

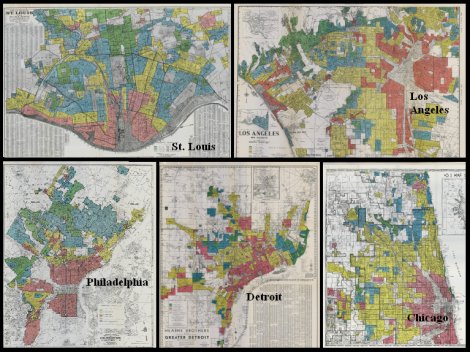

Redlining maps of St. Louis, Los Angeles, Philadelphia, Detroit and Chicago.

Begin Post: Although informal discrimination and segregation had existed in the United States, the specific practice called "redlining" began with the National Housing Act of 1934, which established the Federal Housing Administration (FHA). Racial segregation and discrimination against minorities and minority communities pre-existed this policy. The implementation of this federal policy aggravated the decay of minority inner city neighborhoods caused by the withholding of mortgage capital, and made it even more difficult for neighborhoods to attract and retain families able to purchase homes.

In 1935, the Federal Home Loan Bank Board (FHLBB) asked Home Owners' Loan Corporation (HOLC) to look at 239 cities and create "residential security maps" to indicate the level of security for real-estate investments in each surveyed city. The assumptions in redlining resulted in a large increase in residential racial segregation and urban decay in the United States. Urban planning historians theorize that the maps were used by private and public entities for years afterwards to deny loans to people in black communities. But, recent research has indicated that the HOLC did not redline in its own lending activities, and that the racist language reflected the bias of the private sector and experts hired to conduct the appraisals.

On the maps, the newest areas—those considered desirable for lending purposes—were outlined in green and known as "Type A". These were typically affluent suburbs on the outskirts of cities. "Type B" neighborhoods, outlined in blue, were considered "Still Desirable", whereas older "Type C" were labeled "Declining" and outlined in yellow. "Type D" neighborhoods were outlined in red and were considered the most risky for mortgage support. These neighborhoods tended to be the older districts in the center of cities; often they were also black neighborhoods.

Some redlined maps were also created by private organizations, such as J.M. Brewer's 1934 map of Philadelphia. Private organizations created maps designed to meet the requirements of the Federal Housing Administration's underwriting manual. The lenders had to consider FHA standards if they wanted to receive FHA insurance for their loans. FHA appraisal manuals instructed banks to steer clear of areas with "inharmonious racial groups", and recommended that municipalities enact racially restrictive zoning ordinances.

The Fair Housing Act of 1968 was passed to fight the practice of "red-lining". According to the Department of Housing and Urban Development:

"The Fair Housing Act makes it unlawful to discriminate in the terms, conditions, or privileges of sale of a dwelling because of race or national origin. The Act also makes it unlawful for any person or other entity whose business includes residential real estate-related transactions to discriminate against any person in making available such a transaction, or in the terms or conditions of such a transaction, because of race or national origin."

The Office of Fair Housing and Equal Opportunity was tasked with administering and enforcing this law. Anyone who suspects that their neighborhood has been redlined is able to file a housing discrimination complaint. The Community Reinvestment Act of 1977 further required banks to apply the same lending criteria in all communities. Although open redlining was made illegal in the 70s through community reinvestment legislation, the practice may have continued in less overt ways.

Following a National Housing Conference in 1973, a group of Chicago community organizations led by The Northwest Community Organization (NCO) formed National People's Action (NPA), to broaden the fight against disinvestment and mortgage redlining in neighborhoods all over the country. This organization, led by Chicago housewife Gale Cincotta and Shel Trapp, a professional community organizer, targeted The Federal Home Loan Bank Board, the governing authority over federally chartered Savings & Loan institutions (S&L) that held at that time the bulk of the country's home mortgages. NPA embarked on an effort to build a national coalition of urban community organizations to pass a national disclosure regulation or law to require banks to reveal their lending patterns.

In 1973, when Donald Trump's family’s real-estate company, Trump Management Corporation, was sued by the Justice Department for alleged racial discrimination. At the time, Trump was the company’s president.

The case alleged that the Trump Management Corporation had discriminated against blacks who wished to rent apartments in Brooklyn, Queens and Staten Island. The government charged the corporation with quoting different rental terms and conditions to blacks and whites and lying to blacks that apartments were not available, according to reports of the lawsuit.

Trump responded in characteristic fashion — holding a press conference to call the charges “absolutely ridiculous.” He told the New York Times: “We never have discriminated and we never would. There have been a number of local actions against us and we’ve won them all. We were charged with discrimination and we proved in court that we did not discriminate.”

For many years, urban community organizations had battled neighborhood decay by attacking blockbusting, forcing landlords to maintain properties, and requiring cities to board up and tear down abandoned properties. These actions addressed the short-term issues of neighborhood decline. Neighborhood leaders began to learn that these issues and conditions were symptoms of a disinvestment that was the true, though hidden underlying cause of these problems. They changed their strategy as more data was gathered.

With the help of NPA, a coalition of loosely affiliated community organizations began to form. At the Third Annual Housing Conference held in Chicago in 1974, eight hundred delegates representing 25 states and 35 cities attended. The strategy focused on the Federal Home Loan Bank Board (FHLBB), which oversaw S&L's in cities all over the country.

In 1974 Chicago's Metropolitan Area Housing Association (MAHA), made up of representatives of local organizations, succeeded in having the Illinois State Legislature pass laws mandating disclosure and outlawing redlining. In Massachusetts, organizers allied with NPA confronted a unique situation. Over 90% of home mortgages were held by state-chartered savings banks. A Jamaica Plain neighborhood organization pushed the disinvestment issue into the statewide gubernatorial race. The Jamaica Plain Banking & Mortgage Committee and its citywide affiliate, The Boston Anti-redlining Coalition (BARC), won a commitment from Democratic candidate Michael S. Dukakis to order statewide disclosure through the Massachusetts State Banking Commission. After Dukakis was elected, his new Banking Commissioner ordered banks to disclose mortgage-lending patterns by zip code. The suspected redlining was revealed.

NPA and its affiliates achieved disclosure of lending practices with the passage of The Home Mortgage Disclosure Act of 1975. The required transparency and review of loan practices began to change lending practices. NPA began to work on reinvestment in areas that had been neglected. Their support helped gain passage in 1977 of the Community Reinvestment Act.

In 1975, two years after Trump was sued by the Justice Department for alleged racial discrimination, Trump Management settled the case, promising not to discriminate against blacks, Puerto Ricans and other minorities. As part of the agreement, Trump was required to send its list of vacancies in its 15,000 apartments to a civil-rights group, giving them first priority in providing applicants for certain apartments, according to a contemporaneous New York Times account. Trump, who emphasized that the agreement was not an admission of guilt, later crowed that he was satisfied because it did not require them to “accept persons on welfare as tenants unless as qualified as any other tenant.”

But the company was accused of not sufficiently fulfilling its promise, because three years later [in 1978], the Justice Department charged Trump Management with continuing to discriminate against blacks through such tactics as telling them that apartments were not available. As part of its demands, the government asked that victims of discrimination be compensated and that Trump Management continue to report to the Justice Department on its compliance.

* Almost 40 years later the Clinton campaign is using this as a case against Donald Trump for racism.

Comment: During that same period of time when Trump was being sued for

discrimination, as a young lawyer in 1975 Hillary Rodham was appointed to

represent a defendant charged with raping a 12-year-old girl, which ended with a

plea bargain for the defendant after he passed a polygraph test. Years later

Clinton chuckled about this. Not one person has died as a result of Trump

University; but over 500,000 people died in the Iraq war (not including Libya

and Syria). The bankers who support Hillary Clinton have swindled far more

people (especially minorities) than Trump may have ever cheated (or denied

renting to). And Trump's bankruptcies are very common among big corporations

(such as the airlines, etc.); and remember, Clinton voted to bail out the big

banks and auto companies.

Sources:

https://en.wikipedia.org/wiki/Redlining

http://www.huffingtonpost.com/2011/04/29/donald-trump-blacks-lawsuit_n_855553.html

http://www.factcheck.org/2016/06/clintons-1975-rape-case/

http://am.blogs.cnn.com/2009/06/11/reverse-redlining/

http://dailycaller.com/2012/09/03/with-landmark-lawsuit-barack-obama-pushed-banks-to-give-subprime-loans-to-chicagos-african-americans/

https://en.wikipedia.org/wiki/United_States_housing_bubble

https://en.wikipedia.org/wiki/Timeline_of_the_United_States_housing_bubble

No comments:

Post a Comment