Since the stock market bottomed out on March 6, 2009 (during the Great Recession) corporate profits have soared (Source: St. Louis Federal Reserve).

During that same period of time (from March 6, 2009 until today) stocks on the DOW are up over 135% (Source: Google Finance). Recently stocks have taken a hit because of concerns about China and the global economy (Translated to mean: Not enough people are earning adequate wages to purchase a sufficient amount of goods and services — also known as "supply-and-demand" in the economic system of capitalism).

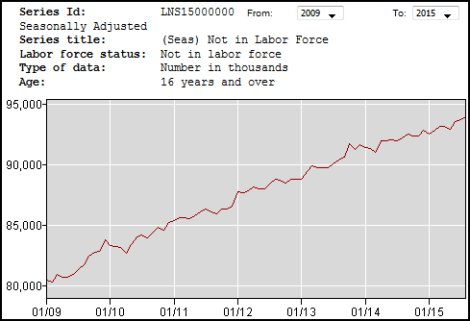

And since March 2009, we also have over 13 million more people "not in the labor force". Unlike the DOW, the number of jobs created didn't rise 135% (Source: Bureau of Labor Statistics).

And also since March 2009, wages have declined. Unlike the DOW, wages didn't also rise 135% (Source: St. Louis Federal Reserve).

The Republicans say lower taxes and more "growth" equates to higher wages and more jobs (known as "trickle-down economics"). But since the depth of the Great Recession, even though stock prices and corporate profits are much higher, a lot more people are "not in the labor force" (they just aren't being counted in the official unemployment rate) — and wages are still down (not to mention, more people are also working part-time and temp jobs).

From the EPI (Economic Policy Institute) The WAGE Act Will Help Strengthen Worker Protections, Raise Wages, and Improve Working Conditions:

On Sept. 16, 2015, Sen. Patty Murray (D-Wash.) and Rep. Robert C. “Bobby” Scott (D-Va.) introduced a billed titled Workplace Action for a Growing Economy (the WAGE Act), legislation to strengthen protections for workers who want to raise wages and improve workplace conditions. The WAGE Act would amend the National Labor Relations Act to help ensure workers are able to have a voice in the workplace and would crack down on employers who break the law when workers exercise their basic right to collective action. In a press conference announcing the legislation, Murray and Scott were joined by AFL-CIO President Richard Trumka and Ross Eisenbrey, Vice President of the Economic Policy Institute.

Of course, the Republican-controlled Congress would never pass such a bill — and the Democrats should have done this in 2009/10 when they had control of the Congress. Now it's all just political posturing for the 2016 general election. Here's more from EPI:

- September 18, 2015: State-Level Data Show Incomes Continue to Stagnate in Households Across the Map

- September 17, 2015: Poverty Day Numbers Show the Need for Higher Wages

- September 10, 2015: H-2B Wage Rule Loophole Lets Employers Exploit Migrant Workers

As the EPI's President Lawrence Mishel had previously explained in another report: “Despite decent employment growth in 2014, the persistent high unemployment yielded no improvements in wages, no improvement in the median incomes of working-age households, and no reduction in poverty. Anyone wondering why people in this country are feeling so ornery should look no further than this report.”

But yet the Republicans are still claiming that if we cut taxes, that will create more jobs and raise wages — but a boatload of evidence over the past 35 years shows that this is not the case. The "extra cash" saved in tax cuts for the very rich and big corporations usually goes into the pockets of these "job creators" — those who don't necessarily create jobs here, (unless they use H-1B visas), but in other countries with lower wages; and /or the "extra cash" is hoarded in offshore tax havens (to avoid taxes); and/or is used to buy back their own stocks (to increase stock prices and executive pay); and/or is used to buy other companies through mergers and acquisitions (and not necessarily competing businesses).

When multi-billionaire Donald Trump was asked in a CBC interview how felt about the fact that the average American CEO makes 350 times what the average American worker makes, he said most CEOs get the pay they do because they install their friends on their boards of directors, who in turn give the executives "whatever they want because the friends love sitting on the boards."

Trump asserted that only 10 percent of the boards of America's public companies exercise what he believes is the required independent judgment when they set executive compensation: "So that's the system we have, and it is disgraceful. You see those guys making these enormous amounts of money. It is a total and complete joke."

Last year in a comprehensive 40-page white paper entitled "Understanding the CEO Pay Debate", Roosevelt Institute researchers Susan Holmberg and Michael Umbrecht flagged the same quid pro quo culture Trump mentioned: "There is strong evidence that companies with higher CEO pay compensate their board members more generously, an indication that board members are engaged in a corporate liaison with CEOs rather than serving as independent parties that can assess the appropriate award for the CEO's performance."

In Trump's Face the Nation appearance, he also said "the hedge fund guys" need to have their taxes raised. Under the existing tax code, hedge fund profits are taxed at a significantly lower tax rate than traditional wage income. Those earnings are not taxed at the same rate as other income (such as regular hourly wages and base salaries). Instead, they are taxed as "carried interest" — just like the profits made on investments called "capital gains".

This generally means the federal government collects no more than 23.8% from hedge fund managers (or from "private equity" investors like Mitt Romney) who use the "carried interest" loophole, just like investors who pay the same tax rate on profits they receive from selling appreciated stocks and bonds — or from the sale of real estate investments (like Trump, or those who own multiple beachfront mansions).

Last month multi-billionaire Warren Buffett (the 2nd richest person in the U.S. behind Bill Gates, and a staunch supporter of the "moderate" Democrat Hillary Clinton) also called for an end to the tax advantage hedge funds get from the carried interest provision.

And Jeb Bush has also come out in favor of abolishing the carried interest provision — but just like other Republicans who want to lower the capital gains tax rate (or eliminate the capital gains tax completely), in Jeb's tax plan he lowers this tax rate from 23.8% to 20%.

The capital gains tax rate on investments in stocks, real estate, fine art, gold (and other precious metals), diamonds (and other precious stones) and wine collections (etc) used to be over 39% before Jimmy Carter lowered it to 28% in 1979. Reagan lowered the rate on capital gains to 20% (but later back to 28%). Clinton lowered it back to 20%, and George W. Bush lowered it to 15% — almost to the lowest level since this tax was first initiated at 12.5% in 1921).

The top tax rate on people who earn regular wages is currently 39.6% — about what the capital gains tax rate used to be in 1979, which is now 23.8% — and the Republicans and billionaires wants this tax rate lower — and are willing to forego the "carried interest loophole" by throwing some hedge fund mangers under the bus to achieve this. (It's all BS folks!) The carried interest loophole SHOULD be eliminated, but the tax on capital gains should also be much higher, not lower.

By throwing the very unpopular hedge fund mangers under the bus, others in their income class (and the super-duper rich like Warren Buffett) may be using "bait and switch" to distract us from the very low tax rate on capital gains.

But why is capital taxed so much lower than labor? Some argue that it's because of the "risk" investors take; but people driving to work "risk" their lives every day. And it's not always a "risk" that investors take, but many times just a "gamble" — and not always with their own cash. In the case of George Soros, who bet $1 billion shorting the British pound, that was also money he could afford to lose, so not so much a "risk" per se because most of us wouldn't do that with our rent money. For the super-duper rich, it's just like a "game" of Monopoly for them.

Many of these people make tons of cash gambling with other people's money (like hedge fund and private equity mangers), and then pay a low tax rate on their "commissions" — but income is income, and besides: investors will always "risk" their cash to make ANY return at all on their investment, so long as it beats inflation. Many times they have no place to "park" their money, and just buy U.S. Treasury bonds, which yields a low rate of interest, but is also one of the safest investments in the world (more below on the subject of quantitative easing).

Most of the billionaires make most of their wealth with capital gains, not carried interest — so just going after the "carried interest tax loophole" (and not capital gains) is mostly only a symbolic and misleading gesture. Just by closing the carried interest loophole amounts to chump change when compared to the capital gains tax loophole.

Donald Trump, Warrren Buffett and Jeb Bush (who say they want to abolish the carried interest loophole) also want to lower the "statutory" corporate tax rate, even though most corporations already only pay about half this as their actual "effective" corporate tax rate. So lowering the corporate tax rate will only provide an increase in revenue stream into the pockets of CEOs and other executive board members (who vote to pay themselves) — and who will pay a capital gains tax on stock options, whose value is increased when their companies use their profits to buy back their outstanding shares of stock (which is also mentioned in the Roosevelt study).

Corporations already have over $2 trillion in profits stashed overseas untaxed by the U.S. government. They have NOT created jobs or raised wages in America. If anything, they've only offhored more jobs to lower wage countries. What they do is buy back their stocks, pay dividends to their investors, then pay themselves enormous salaries. Not to mention, they have spent billions of dollars every year buying out other companies (not raising wages and creating jobs, but usually laying off workers after a merger — a.k.a. "reorganization").

No matter how much profits companies report (or how little they pay in taxes) it usually never translates into more domestic investment, more jobs being created or higher wages. When the "economy" grows, it's usually just good news for Wall Street, not workers — except for maybe, there won't be as many layoffs.

Oops!!! On September 15, 2015 Hewlett-Packard just announced they're going to ax another 25,000 to 30,000 jobs. That's after the current GOP presidential contender Carly Fiorina, the former CEO of HP, had already axed 30,000 jobs by offshorng them to China.

An Aside about Quantitative Easing and Interest Rates

Basically, quantitative easing (QE) is when America's "central bank" (the Federal Reserve) gives free money (near 0% interest) to the large commercial banks. Just like with QE, the stock market usually bumps higher on news that the Federal Reserve won't raise interest rates. But then again, sometimes it doesn't:

New York Times: "The Fed highlighted the improving state of the American economy as the job market continues to rebound [not true at all]. But the outlook — particularly deepening concerns that China’s economic slowdown could weigh on the continuing recovery in the United States — prompted the Fed to keep interest rates at ultra-low levels [near 0%]. The Fed’s decision weighed on global markets Friday, and Wall Street opened lower as well after edging down modestly the day before."

Some debates includes those who favor keeping the interest rate low until we get to "full employment" and wages rise. But we've been near 0% since the Great Recession and that hasn't happened. Millions have dropped out of the labor force and wages are still down.

Others argue that low rates are good for consumers who take on auto loans, mortgages, college loans and credit card debt (but then, why can't regular consumers just go to the Fed window like the commercial banks?)

And others argue that is sucks for savers who are trying to build up a nest egg for retirement (or whatever). Others say inflation is also big factor — even though inflation has been very low by some measures, especially if one includes the recent low price of oil. From the Economic Policy Institute (September 16, 2015) The Real Stakes for This Week’s Fed Decision on Interest Rates:

Inflation has been running below the Fed’s target for years—and its recent moves have been down, not up. This subdued price inflation is not a puzzle; it’s the outcome of a labor market that remains so slack that nominal wage growth is running about half as fast as a healthy recovery would be churning out.

Some people argue that it's primarily the very rich (the asset class) who mostly benefits from the Fed's low interest rates. Here's a recent article with some interesting reader comments about the Fed's decision not to raise interest rates.

And this is from earlier in 2013, by Aljazeera: Real Money Matters:

Since November 2008, the Fed has pumped roughly $3 trillion into the economy, and two-thirds of it is sitting in the Federal System earning interest for big banks. The majority of the funds created by QE are gathering dust in the Federal Reserve System as excess reserves over and above what commercial banks are required to hold to protect against loan defaults. Excess Reserves of Depository Institutions have exploded from $267 billion in October 2008 to $2.2 trillion in September 2013. Banks aren’t willing to lend the money out or because there simply isn’t the demand for the loans that could be created. Either way, the banks don’t have to lend excess reserves to realize a return because the Federal Reserve pays 0.25% interest on them.

From Andrew Huszar at the Wall Street Journal Confessions of a Quantitative Easer:

"I can only say: I'm sorry, America. As a former Federal Reserve official, I was responsible for executing the centerpiece program of the Fed's first plunge into the bond-buying experiment known as quantitative easing. The central bank continues to spin QE as a tool for helping Main Street. But I've come to recognize the program for what it really is: the greatest backdoor Wall Street bailout of all time."

Tax cuts don't create jobs, but tax increases on capital gains to invest in infrastructure would — and "growth" in the stock market or untaxed corporate profits doesn't raise wages, but raising the minimum wage to create more "demand" in consumer spending would sure help a lot.

And if you disagree with me, that makes you a shill for the super-duper rich and largest multi-national corporations. But if you agree with me, then vote for Senator Bernie Sanders as President in 2016.

Brookings Institute: "The typical male U.S. worker earned less in 2014 than in 1973. The typical man with a full-time job — the one at the statistical middle of the middle — earned $50,383 last year, the Census Bureau reported this week."

ReplyDeletehttp://www.brookings.edu/research/opinions/2015/09/17-male-us-worker-earned-less-in-2014-than-in-1973-wessel

$50,383 a year? Is that "gross" annual income or "average" annual income or annual "median household" income? Because wage data from Social Security shows:

"50 percent of wage earners had net compensation less than or equal to the median wage, which is estimated to be $28,031."

http://www.ssa.gov/cgi-bin/netcomp.cgi?year=2013